Multichannel selling is the process of selling products across multiple channels. For example, a multichannel retailer might have its products available to buy through a mobile app, social media platform, and online store.

In 2020, multichannel online retailers generated more than $350 billion in sales. It’s a retail strategy not set to slow down anytime soon. By 2023, experts predict that multichannel sales will account for 46% of all ecommerce sales.

Unsure on whether you should expand your focus to sell on other channels? This guide shares the channels typically involved in a multichannel selling strategy, the operational challenges of selling multichannel, and brands that have succeeded when selling alongside an online store.

Table of Contents

What is multichannel selling?

Multichannel retailing is a strategy that makes a business’ products available wherever a customer would want to buy them—both online and offline.

Brands with a multichannel selling strategy might sell products through their own ecommerce website, on marketplaces like Etsy, in a brick-and-mortar store, and through a mobile app. Each channel is equipped to handle purchasing.

In other words: multichannel blends the customer experience and gives consumers the choice to engage in the channel of their preference. Retailers don’t miss out on purchases happening outside of their own website.

Essential multichannel selling channels

If you want to get the right product in front of the right customers at the right time, these are the different channels you should have in place.

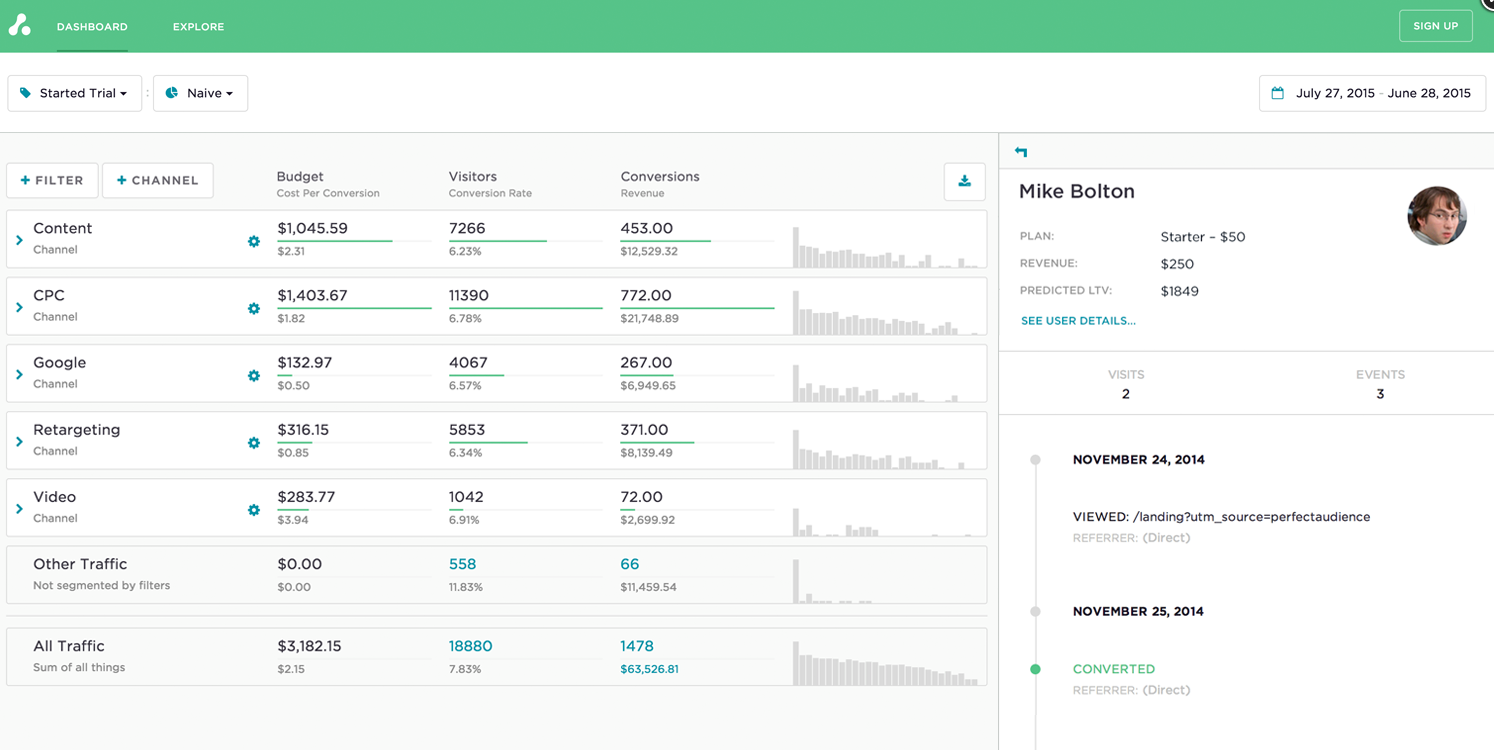

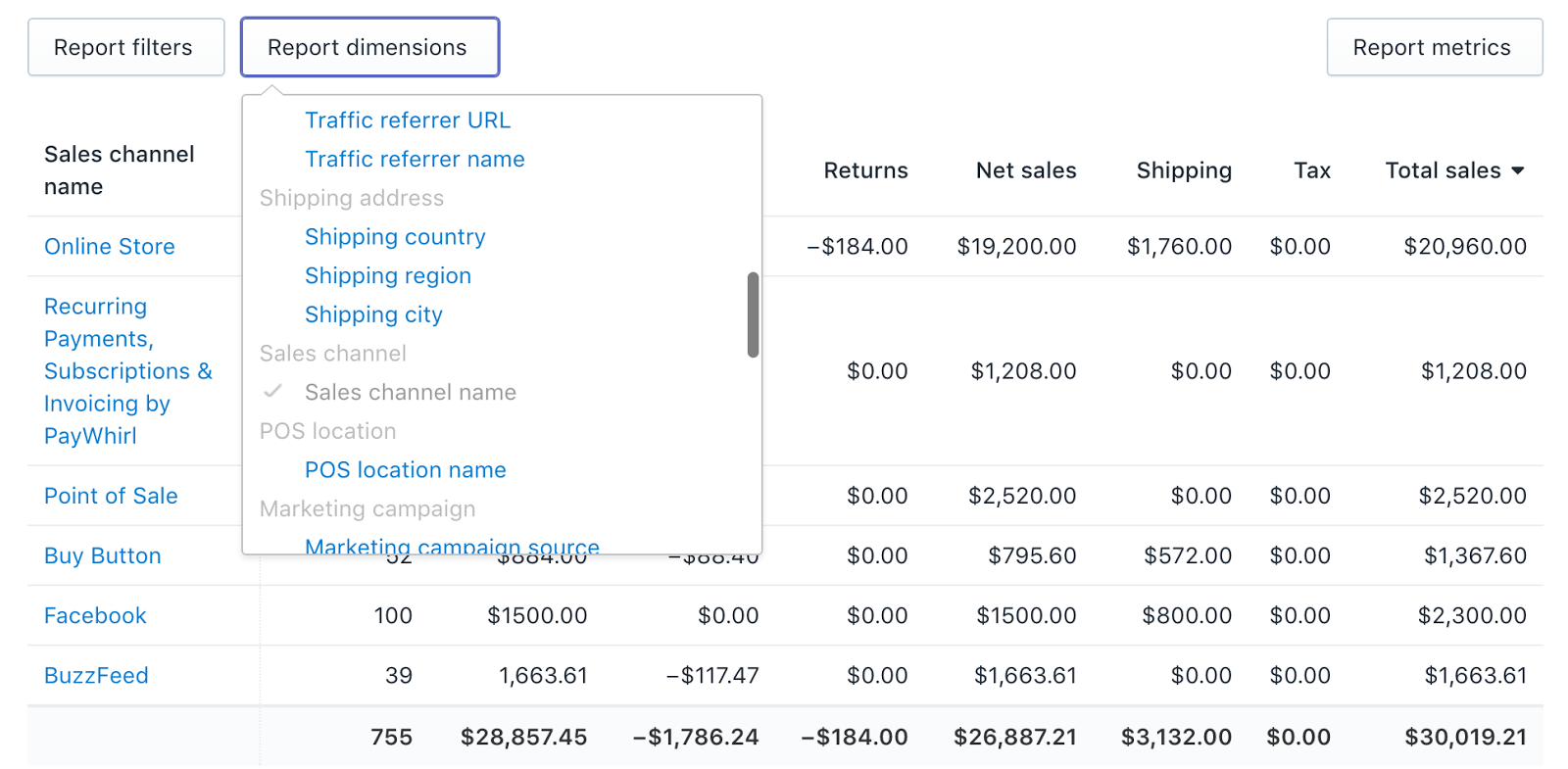

Shopify Plus offers more than 20 different sales channels under one easy-to-manage ecommerce software roof. Merchants can view sales by channel in their dashboard—you can instantly compare performance on an apples-to-apples basis and uncover your most profitable sales channels.

A responsive and fast online store

An online store is a virtual home for many businesses. It likely forms the biggest part of your multi-retail strategy, especially if your brand is well known. People can type your URL into their web browser, view the products you have for sale, and check out.

Because it’s easier than ever to buy items virtually, online sales have hit a record high. Consumers spent $222.4 billion in Q2 of 2021, up 9% from the same period last year. While the COVID-19 pandemic forced shoppers online, their reliance on ecommerce websites is now stronger than ever. Modern brands are expected to have an online store.

Those expectations aren’t as simple as you might think, though. A poorly performing ecommerce website is almost as bad as not having one at all.

It’s tempting for retailers to go overboard with their online store. It’s one of the only places a brand has total control over the experiences it gives to its customers. High-quality product photos, fancy web design, and augmented reality provide unique experiences. That comes at a cost.

Millisecond delays in ecommerce website loading times cost retailers millions. Just a one second delay can tank conversions by 7%. There’s a trade-off between performance and functionality. The sweet spot? Somewhere in the middle.

Direct-to-consumer

Direct-to-consumer commerce is a strategy brands use to cut out the middlemen and sell their products directly to the end consumer.

Research shows that two out of every five US consumers have purchased a product from a DTC brand. It’s why more than half of manufacturers are incorporating DTC into their retail strategy.

Brands choose the DTC model because they have greater control over the experiences they’re giving to customers. Everything from distribution to supply chain is in their control, resulting in healthy profit margins and faster product development cycles. Plus, you’re not at the mercy of a marketplace’s algorithm—one with the potential to show your products to millions—and take it away within seconds.

However, the DTC model does have its downsides. The main one? Investing time and money into marketing. You can only sell directly to the consumer if the consumer knows your brand exists. By incorporating DTC with other sales channels in a multichannel selling strategy, such as online marketplaces, you get the best of both worlds.

Social media channels

Long gone are the days of businesses using social media as a driver of traffic to their websites. Social media platforms play large roles in modern purchasing journeys, with social commerce projected to reach $79.6 billion by 2025. That’s about 5.2% of US ecommerce sales.

Alongside audience building, many platforms have evolved to facilitate these social-media-led purchasing decisions without forcing shoppers to a brand’s website. Facebook and Instagram shops, for example, handle the entire purchasing process. Customers can discover, browse, and purchase products without leaving the app.

Most social media platforms have an obvious incentive to push sponsored product listings to their users. Facebook claims 5% of all product sales are made through a brand’s shop. But it’s a double-edged sword: despite access to its 4.2 million-strong user base, a 5% stake in every sale narrows profit margins. That’s on top of any advertising you do to promote your shop listings.

Online marketplaces

Looking for a quick way to tap into an audience of customers searching for products like yours, without investing heavily into marketing or advertising? Global marketplaces provide retailers with another channel to sell through—most of which grant access to built-in audiences in exchange for a percentage of revenue a retailer generates.

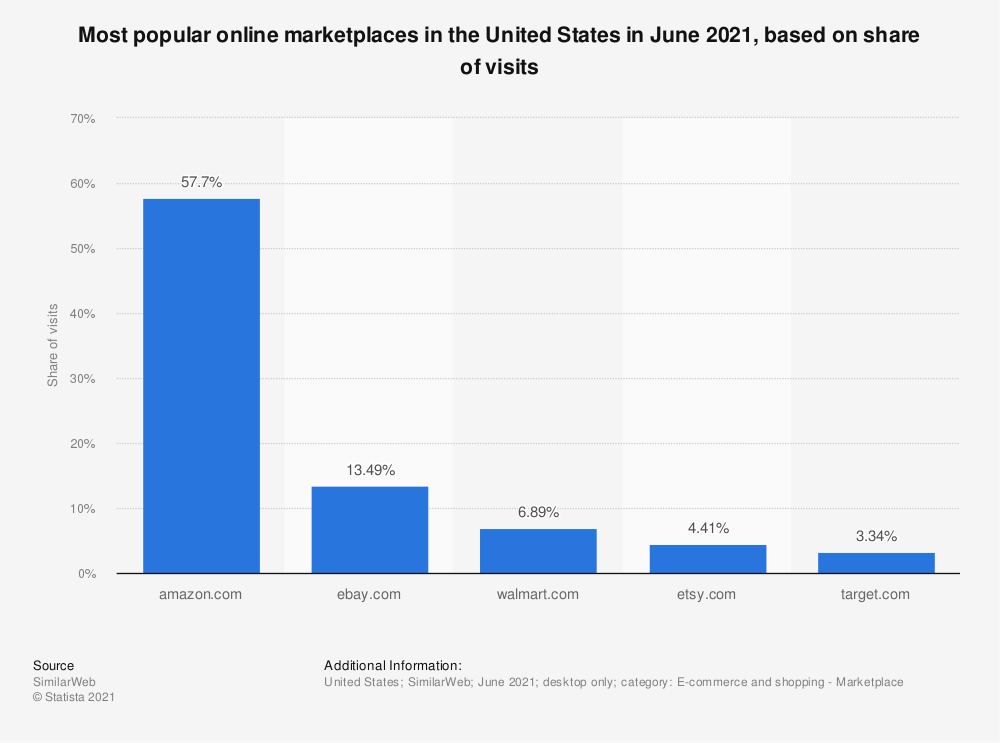

Amazon rules the roost in terms of marketplace popularity. However, depending on a retailer’s target audience, they can find success by adding eBay, Walmart, Etsy, or Target to their multichannel selling strategy.

The downside to these marketplaces is you’re at the mercy of their rules. A simple algorithm tweak could tank your visibility overnight. It’s like building a foundation on rented land, hence why retailers choose to make marketplaces a small part of their multichannel strategy. They get the benefits of a marketplace’s huge audience size while mitigating risk.

Brick-and-mortar stores

Brick-and-mortar retail stores began to open up after being forced shut for the COVID-19 pandemic. While in-store shopping is not as popular as it was, almost half of consumers still prefer in-person over online shopping. Some 60% of those shoppers say they’re likely to spend more when shopping at physical stores.

As part of a multichannel strategy, brands can use retail stores as a way to reach local customers. Magnolia Market, for example, has a flagship store in Texas. Its store reports more annual visitors than the Alamo.

You don’t even have to operate your own store to capture offline shoppers. Partnerships with department stores like Target, Macy’s, and Nordstrom act as offline marketplaces. Get your products stocked there and you reach shoppers who prefer to shop in-store without the associated costs of opening a retail location.

Retailers are even blending online and offline commerce to get the best of both worlds. Shoppers can use their smartphones to do pre-store visit research and even view product information on their smartphone while visiting the store. Customers wind up making their purchase through POS systems, such as Shopify POS.

Either way, the beauty of brick-and-mortar retail is the ability to give in-person experiences. Brands can get involved in the local community, host events, and decorate their store. In exchange, they face higher operating costs like store rent, decor, and insurance, or a cut to their margins when selling to big-box retailers.

Mobile-friendly websites and apps

By 2025, it’s predicted that 10.4% of all retail sales will happen via mobile commerce—the biggest retail sales growth of all, beating other sales channels like in-store shopping and traditional ecommerce.

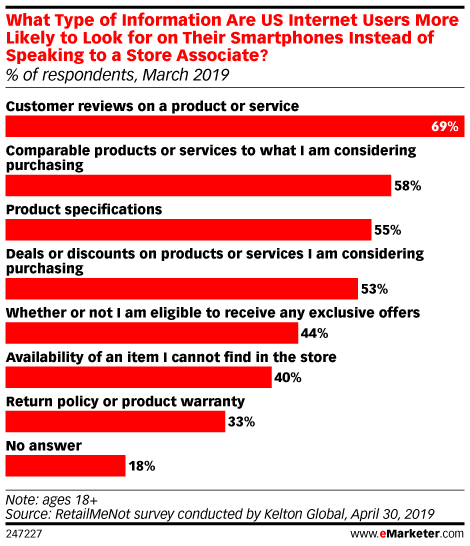

Consumers are consulting their mobile devices when in-store. Data from RetailMeNot found 69% of shoppers use their mobile device to search for customer reviews. Another 58% search for comparable products, and 55% rely on their mobile internet connection to view product specifications.

Some retailers—including Best Buy and Chewy—take mobile commerce to the next level by creating custom mobile apps. In Q4 of 2020, some 47.7 million consumers downloaded a mobile app from a brick-and-mortar retailer. More than half of those shopping apps are used weekly, with consumers relying on them to discover new products, join loyalty programs, and claim special offers.

By incorporating mobile into your multichannel selling strategy, you can reach target customers already using their smartphone to shop.

Wholesale

Wholesale ecommerce is a lucrative business model for retailers who get it right. In June 2021, wholesale sales in the United States amounted to $588.13 billion.

Instead of selling directly to the general public, retailers with a wholesale arm sell products to other businesses through a private portal on their ecommerce store. Those items are usually sold in bulk at a lower cost.

Take Laird Superfood, for example. Alongside a DTC ecommerce website, its wholesale customers can place orders through an online portal, complete with negotiated prices and order history information. The wholesale business now accounts for 75% of all revenue.

Being able to automate the wholesale process changes how we build our team. It prevents us from missing 2 a.m. orders and keeps our customers from having to wait to place an order until we’re in the office. It just solves so many problems.”

—Luan Pham, CMO of Laird Superfood

The benefits of multichannel selling

Selling multichannel might sound like a logistical nightmare, but retailers rely on the strategy for many reasons. Here are the benefits of selling multichannel.

Wider audience reach

You can have the best ecommerce website in the world; one that delivers one-of-a-kind experiences to customers. But the only people you’ll reach are those who know about your brand already. You’ll need marketing and advertising campaigns to raise brand awareness.

However, the benefit of selling multichannel is the ability to tap into established audiences. Just take these statistics:

Around seven in 10 people use marketplaces to buy non-essential items online.

More than 56 million Facebook users have purchased products through the platform.

There are 298 million smartphone users in the US, almost half of which have purchased a product online via their mobile phone.

Across each channel, calls-to-action and engaging ad copy can only work so well. Brands accept the fact not everyone who sees their content will have the desired effect. Sometimes, it’s easier to take payment for products there and then, as opposed to convincing potential customers to pry away from the channel they’re using and toward your website.

It’s likely why multichannel retailers perform significantly better than their online-only counterparts, with an average sales growth of 57% compared to just 9.1% for ecommerce brands.

Improved customer experiences

“A single customer can learn about a business or make a single purchase over multiple channels, such as learning about a brand on Facebook and making a purchase on an ecommerce site,” says Gerrid Smith, CMO at Joy Organics.

It’s true: studies show that customers are using up to 20 channels and devices before adding an item to their online shopping cart—and they expect experiences to be consistent across them all.

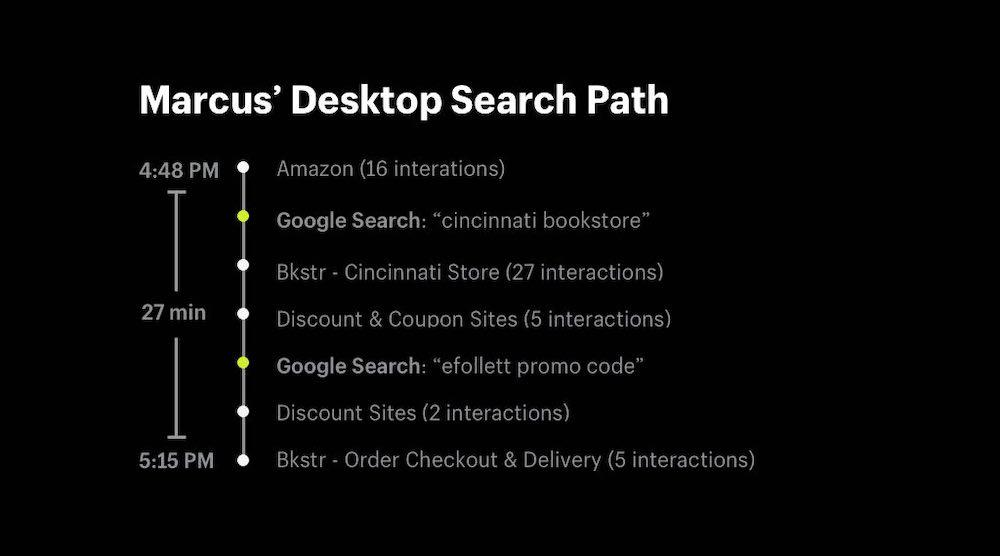

Google’s proprietary data and customer interviews reveal how those shoppers arrive at their purchase decisions. Let’s take their example of “Marcus,” who was shopping for a gift from a local bookstore. Marcus started his research with Amazon, then conducted two Google searches: one by location and one by brand. He also visited discount and coupon sites before buying online.

Google has expanded its research to demonstrate how each channel lines up with most marketing and sales funnels. The majority of the buying process happens before someone lands on your site (or even discovers your brand). Google calls this the “Zero Moment of Truth”—the timeframe in which someone researches a product before deciding to buy. It looks something like this:

Shoppers often discover new products through social and display ads.

They start with generic product, category, or local searches to compare options.

When they’ve narrowed their list, they do brand-related searches, plus seek reviews and referrals from friends.

They might even sign up for emails from the brand they’re evaluating to access discounts and promotions.

Finally, they make their purchase through your ecommerce site, app, or store.

Gerrid says, “While multichannel selling allows you to be present at different points in a single buyer's journey, it also allows you to appeal to diverse types of buyers. For example, you might realize that your Etsy audience differs from your Amazon customers.”

Gerrid continues, “While you’ll keep your branding similar across all channels, a multichannel strategy allows you to customize the experience for each platform’s audience by changing your messaging or even introducing new products. As a result, your customers will have a more personalized and ultimately more effective experience, which can lead to more sales.”

Stronger customer loyalty

Selling anywhere your customer wants to buy makes your products more accessible. Because of this, an IDC Retail Insights report revealed that multichannel consumers spend more money, resulting in:

15%–35% higher average transaction

5%–10% higher loyal customer profitability

30% higher lifetime value than single-channel shoppers

One study published by The International Journal of Retail and Distribution Management also concluded that online loyalty is largely driven by offline loyalty. In other words: nail the experience you give to shoppers in your retail store. They’ll continue making purchases through online channels, increasing retention and customer lifetime value.

Multichannel retailers should focus on building trust and attachment toward the brand if they want to get online and offline loyalty. The efforts to build stronger bonds between the customer and the retail brand translate into higher loyalty, particularly toward the offline channels.”

Reduced operational costs

The idea that multichannel retailers reduce operational costs might sound counterintuitive. Sure, retailers selling across several sales channels have expenses unique to each platform—there are marketplace fees, social commerce ads, and mobile app development costs to factor into channels outside of your own ecommerce site.

However, widening your sales channels has operational cost savings, as Jesse Kaufman, founder of ShippingTree says, “A huge benefit of selling across multiple channels is that you’re naturally going to be ordering much more inventory compared to selling on just one or two channels. This will allow you to lower your costs, which flows down to your bottom line.”

Support for charitable causes

Not all multichannel selling innovation is for profit. Back in 2018, Lay’s wanted to raise awareness and $1 million for Operation Smile, a charitable organization that provides surgical care for children affected by cleft conditions.

The Smile with Lay’s campaign captured shoppers through a customized multichannel experience. At Times Square in New York City, Lay’s opened a funhouse pop-up store that featured celebrity ambassador Jordin Sparks and a life-size Mr. Potato Head.

Specially designed bags of Lay’s were also available for almost two months in stores, with a portion of proceeds going to Operation Smile.

A unique ecommerce storefront was built to take the multichannel strategy to new heights by allowing shoppers to customize bags of chips with their photo on the front...

…and a personalized message on the back.

Even though the chips came with a much higher price point than other items ($10.99), the campaign was a huge hit, proving consumers are often willing to pay extra for a feel-good, personalized ecommerce experience. The campaign also reached its $1 million fundraising target and created an invaluable DTC brand relationship.

The challenges of multichannel selling (and how to overcome them)

Multichannel selling offers your customers a better overall experience as you mirror how they already shop. Even better, that strategy increases your profitability.

Though it has some marketing and operational challenges, the solution is to centralize and streamline your multichannel back-end operations as much as possible while supporting your front-end user experience.

But without a proper multichannel retailing and marketing strategy, you could end up spreading your resources too thin, while hurting your customer experience in the process. Here are five challenges to consider and how to overcome them.

Marketing and promotion

Think of a multichannel marketing strategy as a wheel with spokes. At the center of the wheel is your product (i.e., a sale). On the outer rim of the wheel are your customers, where each channel offers a separate and independent opportunity to purchase.

Once it’s clear which channels resonate best with your target market, you can optimize marketing in those channels to maximize sales.

However, it’s important to think of your marketing and promotional strategies from a channel perspective. It might be counter-productive to drive customers from Facebook to your website with an ad when they can often purchase faster and more conveniently through Messenger.

An ad budget of $15,000 allocated to Google Shopping to drive sales through your online store sounds logical. But if you decide to add a Facebook store, Buyable Pins on Pinterest, and shopping through Instagram Stories, then you’ll need to divide your ad spend by four.

That’s not a big issue for mature companies that can afford to diversify and allocate resources accordingly. But high-growth businesses might struggle to achieve the same goals.

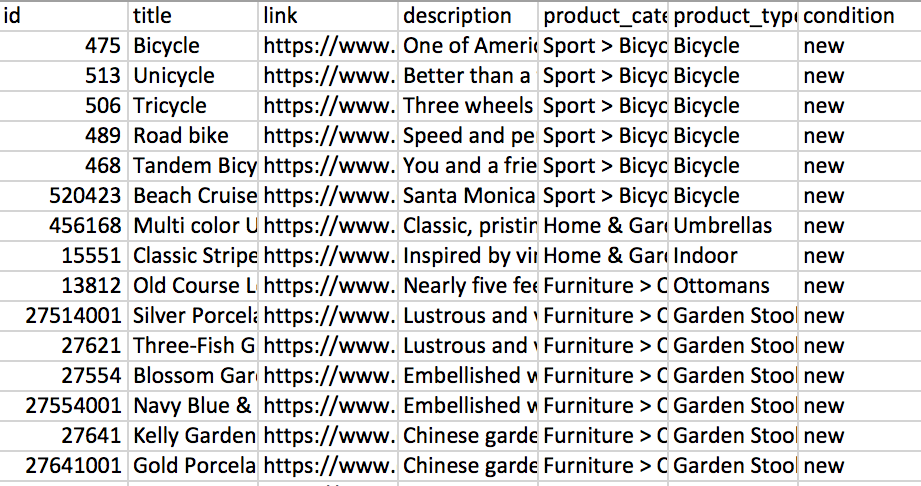

A good solution is to allocate your budget and resources by funnel stage, rather than channel. For example, your social and display ad budgets can work together to build brand awareness. Then, you can retarget previous site visitors of your Google Channel campaigns or Facebook Dynamic Product ads to get similar results for less money than investing in general campaigns farther down the funnel. You can also create a product feed that works by listing all-new product details.

Together, those platforms allow you to create templated ads that will automatically pull in product data based on each shopper’s experience. If someone browses a “rainbow colored umbrella” on your site but doesn’t buy it before leaving, you can retarget ads to them on Facebook.

The Honest Company achieved a “34% increase in click-through rates and a 38% reduction in cost per purchase” with these ads, according to Facebook.

Retargeting campaigns like these also help you stretch resources and increase your results by decreasing costs. Once you’ve done the upfront work to get the ads up and running, you only need to maintain them going forward, because the day-to-day execution is mostly automated.

The only challenge with this approach is that it’s going to interfere with your ability to attribute sales properly.

Sales attribution

Speaking of attribution, let’s go back to the $15,000 ad-spend example. Assume you have the budget to spend at least that much on each channel you’ve identified to grow your business. You still have to figure out how to measure the return on investment for each.

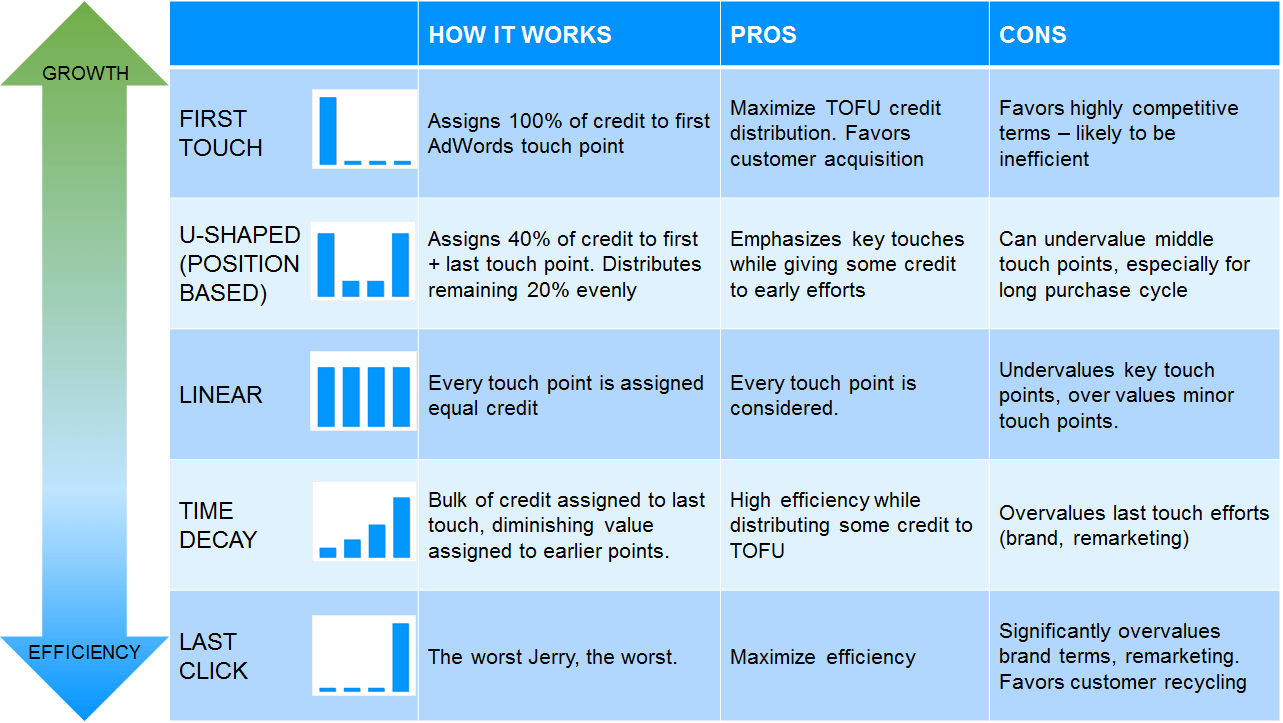

The challenge with multichannel retailing attribution is one channel will assist a sale that happens through another channel. In your store’s Google Analytics, you’ll see that it probably defaults to last-touch attribution. That means it will give 100% of the credit to your PPC or organic search campaign because it was the last touchpoint a customer had—the one that drove them to your site.

Unfortunately, that sales attribution model ignores all your efforts and budget allocated to Facebook to build awareness, or to Amazon to develop trust.

There’s no right answer when it comes to selecting an attribution model. If your job is to run Facebook ads, you might prefer a first-touch attribution model that emphasizes how customers discover your products, so you can connect a direct line between your campaigns and results.

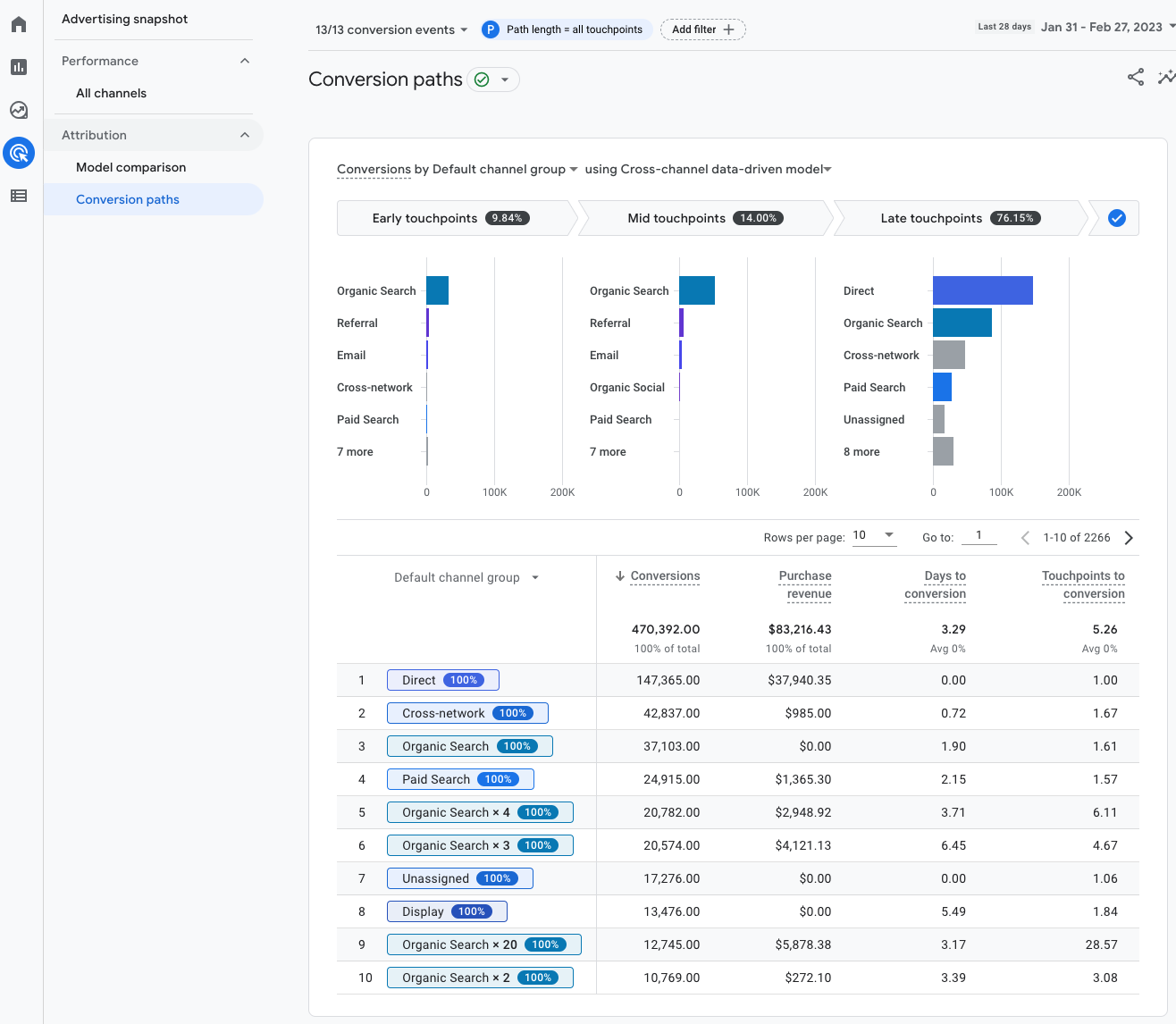

If you’re in upper management, you might want an attribution model that does a better job of blending the performance of all channels. The Conversion paths report in Google Analytics indicates your customers’ paths to conversion, and how different attribution models distribute credit on those paths.

Access the conversion paths report by following the steps linked here.

Some enterprise ecommerce solutions offer detailed attribution tracking and apps, like Shopify’s Attribution Connector, which will apply custom algorithms to the data inside your store. As a result, you’ll get an accurate estimate of return on ad spend.

Inventory management

Serving your customers’ buying habits better is possible through a multichannel sales and marketing approach. But internal systems don’t always integrate data from different channels back to a single source.

If this is the case and your sales rapidly scale from 1,000 to 100,000 per month, or those sales are split between your site, a physical location, and Facebook, you might find yourself in a messy situation.

“Without proper inventory management, it’s likely that you’ll run out of products and have inaccurate inventory valuation, which often leads to lost customers or over or under-buying stock,” says Jara Moser, Digital Marketing Manager at Shopventory. “Streamline and automate your inventory management processes before expanding into multiple sales channels to ensure a smooth transition.”

An inventory management system (IMS) offers three key benefits:

It streamlines the fulfillment process to procure, organize, ship, and arrive quickly at a customer’s door (or retail location).

It prepares for unexpected sales spikes or seasonality.

It avoids inventory shortages when products are sold simultaneously through multiple channels.

To illustrate, MVMT has been extremely successful in selling its watches natively through a Facebook store over the past few years.

It’s convenient for shoppers, but without control over multichannel inventory management and logistics, the customer experience could suffer if Facebook orders aren’t synced with online store orders on the back end.

Another great example of smooth back-end and front-end tech integration comes from Nike’s Jordan brand. More than 15 years after Michael Jordan retired from the NBA, the Jordan brand continues to flourish, thanks to innovation.

Back in 2018, the retailer hosted a pop-up location in Los Angeles. Snapcodes (QR codes powered by Snap) were displayed for shoppers to scan with Snapchat cameras. The codes unlocked an in-app commerce experience that allowed the brand’s latest sneakers—not in stores for another month—to be immediately purchased through Snapchat.

More recently, the company built on its social commerce strategy with Snapchat Bitmoji avatars. Users can dress their Bitmoji in Jordan-branded shirts, jackets, pants, and sneakers. It’s this type of digital sales channel that added $900 million in incremental revenue for Nike.

Pricing

Have you ever researched prices for a hotel room or flight one day, then gone back the next to find the cost had skyrocketed? Travel bookings are based on demand, so the more people shop on popular dates, the higher the price.

There are pricing discrepancies between channels too. Many hotel brands will promote a lower price on sites like Expedia and Hotwire than on their website. In doing so, they teach their customers to buy from those sites, leaving the hotel with a lower margin booking.

The same scenario happens on Amazon for many DTC brands, causing pricing pressure and a higher revenue-share deal that can drive down your profit margins.

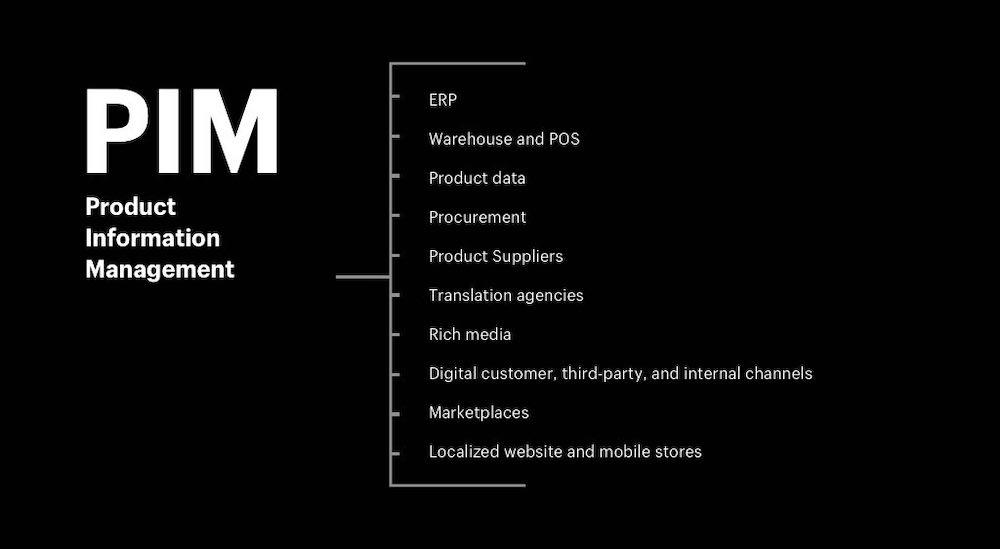

To control these discrepancies, manage everything centrally through a product information management system (PIM). This strategy lets you control which product data gets distributed to your sales channels, including SKU data, product descriptions, item price, images, and videos.

Companies equipped with a PIM achieve myriad positive results, including:

67% lower labor costs

Up to 23% fewer product returns

20% increase in employee productivity

PIM solutions like Jasper and Salsify work with Shopify Plus stores. Their apps pull product information from several channels—including your ecommerce store, marketplace listings, Facebook shops, and more—so you can change product data across the board in one click.

Logistics

Serving your customers’ buying habits better is possible through a multichannel sales and marketing approach. But internal systems don’t always integrate data from various channels back to a single source.

One way to protect your business from unexpected cross-channel sales spikes is to combine the best of an IMS with a multichannel order management system (OMS).

An OMS pulls your sales data from marketplaces and other third-party sites into your enterprise ecommerce platform. That way, you can investigate which channel produces the highest value customers, like those with the highest repeat purchases or lifetime value.

Your ecommerce platform admin panel should break it down for you at a glance. Otherwise, try drilling down into your reporting section to analyze the details.

Shopify automates all of our essential business processes, including taking and processing secure customer payments, into one centralised location, meaning that we have more time and resources to focus on producing the best possible products for our customers. Shopify is able to adapt with us as we grow as a company, which is a huge advantage for us.”

—Annie Wang, Director of Marketing at Small Smart

Let’s put that into practice and say 60% of retail sales come from point-of-sale (POS) equipment in your ecommerce store. Just 5% of sales happen through Amazon.

In that case, it makes sense to prioritize stock levels in your brick-and-mortar store. Sending too much inventory to an Amazon warehouse facility could be costly—not just in terms of their storage fees, but in opportunity cost. It’s better to store that inventory at your retail location where more customers buy the product.

Want to take this off your plate altogether? James Khoury, CEO at Zendbox, recommends leaning on a third-party logistics (3PL) partner who “will manage all your channels, making sure stock is always accurate and synced live.

“It's an all-encompassing positive of each stage of the fulfillment process being covered across multiple channels or storefronts, rather than having separate operations for each (which can be very difficult to manage and logistically taxing to scale).”

The difference between single, multi- and omnichannel

Multichannel selling is a strategy for selling across several channels. Each channel has its own purchasing capabilities; people don’t need to visit your website to buy something.

Omnichannel retail, on the other hand, is immersive and puts the customer—not your product—at the core. Rather than treating channels as independent silos, omnichannel marketing merges the worlds of websites, emails, retargeted ads, social media marketing, and physical locations to show personalized offers, products, and messages.

Single channel retail is even simpler. It’s the basic act of selling through a single channel. For example, a brick-and-mortar store without an online website.

Multichannel selling examples

Are you convinced to experiment with multichannel retail, or to add another sales channel to your strategy? Let’s take a look at three brands’ approaches to multichannel retail and why they’re so effective.

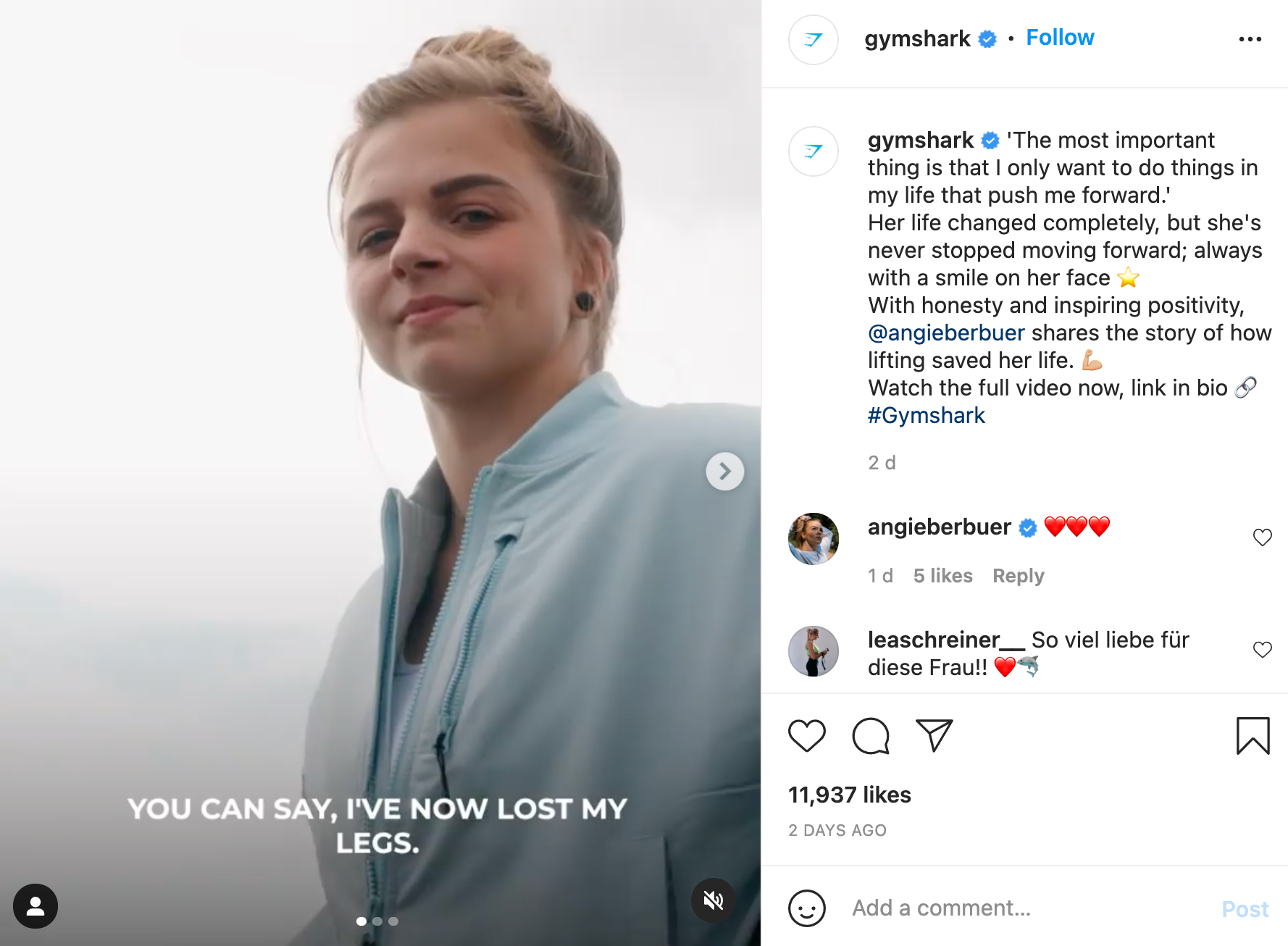

Gymshark

Gymshark is the fastest-growing fashion brand in the UK. Part of its $1.3 billion valuation lies in its strong relationships with customers. Data shows that almost half of the brand’s revenue comes from returning customers.

Here’s how the brand uses a multichannel approach to drive customer loyalty.

Channel 1: Ecommerce store

Every spoke on Gymshark’s multichannel marketing strategy directs people back to its website.

With millions of Instagram followers, an engaged Facebook community, and a popular YouTube channel, on the surface, it seems like Gymshark uses a single-channel DTC strategy. You won’t find its products being sold elsewhere online.

Channel 2: Pop-up stores

Dive deeper into Gymshark’s retail strategy and it’s clear the brand focuses on sales channels where the customer relationship is owned completely.

Its pop-up stores are a prime example. Customers flock to them all across the world—Birmingham, Sydney, and Toronto included. At its Toronto pop-up, the fitness brand sold 90% of its product on the first day.

By inviting brand ambassadors and influencers to its pop-ups, Gymshark combines online and offline channels, contributing to its loyal fanbase.

We get goosebumps watching Gymshark customers who have driven hundreds of miles to meet their fitness idols face to face. People are fascinated with athletes and these meetups and pop-up stores remove the layer between fans and their heroes and create emotional experiences that are truly moving.”

—Ben Francis, founder of Gymshark

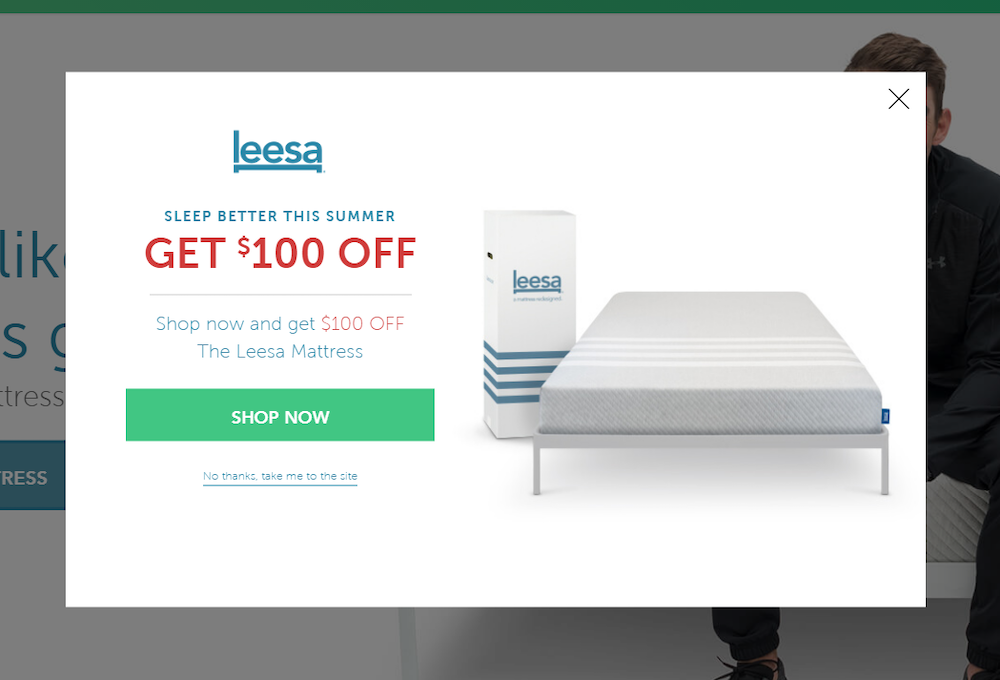

Leesa

Online mattress seller Leesa sells products through its own ecommerce store and social media. Each channel in its multichannel strategy exists as a separate purchase opportunity.

Channel 1: Ecommerce website

Leesa’s ecommerce website acts as the virtual home for its products.

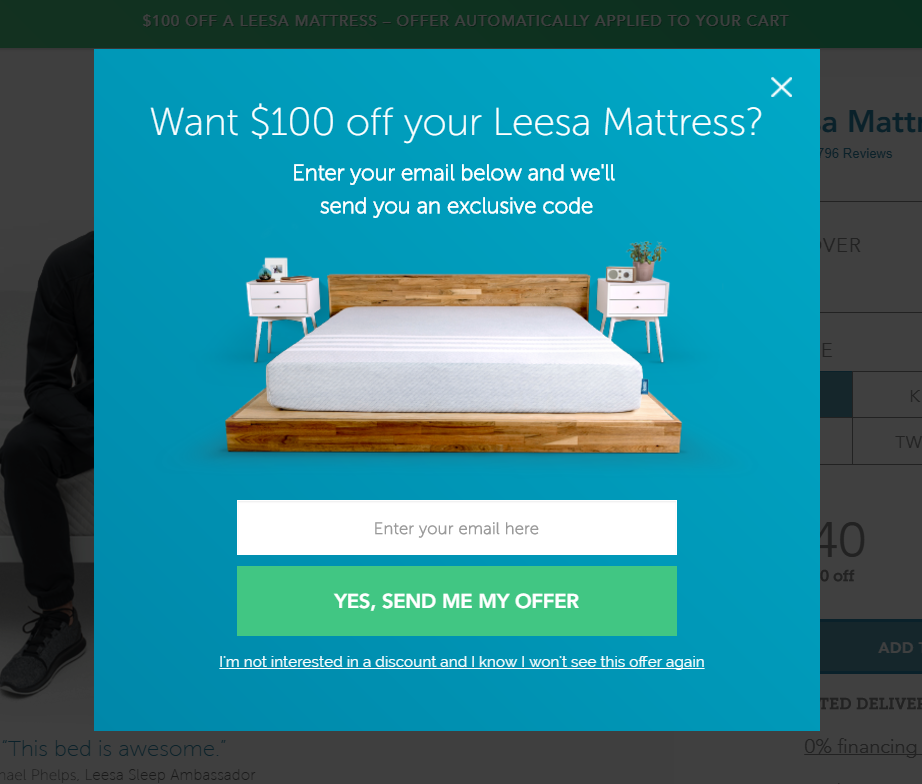

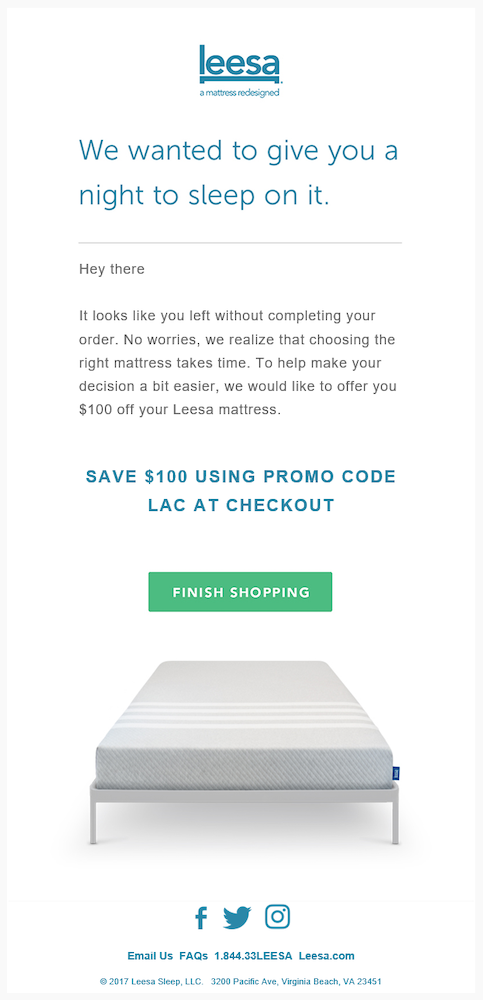

First-time visitors without existing accounts are presented with two overlays. First, a welcome message with a “$100 off” offer with a subtle seasonal touch:

Ignoring the offer and browsing the site results in a second overlay. In this instance, let’s say a user selects a mattress, adds it to cart, but abandons before purchasing. Before bouncing, the user sees a “$100 off” CTA pop up, accompanied by an email opt-in giving Leesa permission to target the user later:

Users who opt-in receive a series of emails aimed at converting first-time buyers.

Click “Finish Shopping” and the user is sent back to the cart they abandoned with the $100 discount automatically applied:

Email and on-site operate in tandem; the two feel like a single channel.

Channel 2: Marketplaces

Leesa also sells its products on Amazon. If a user abandons cart on Leesa’s site to see if they can find a cheaper product on Amazon, Leesa remains top-of-mind with its sponsored search result:

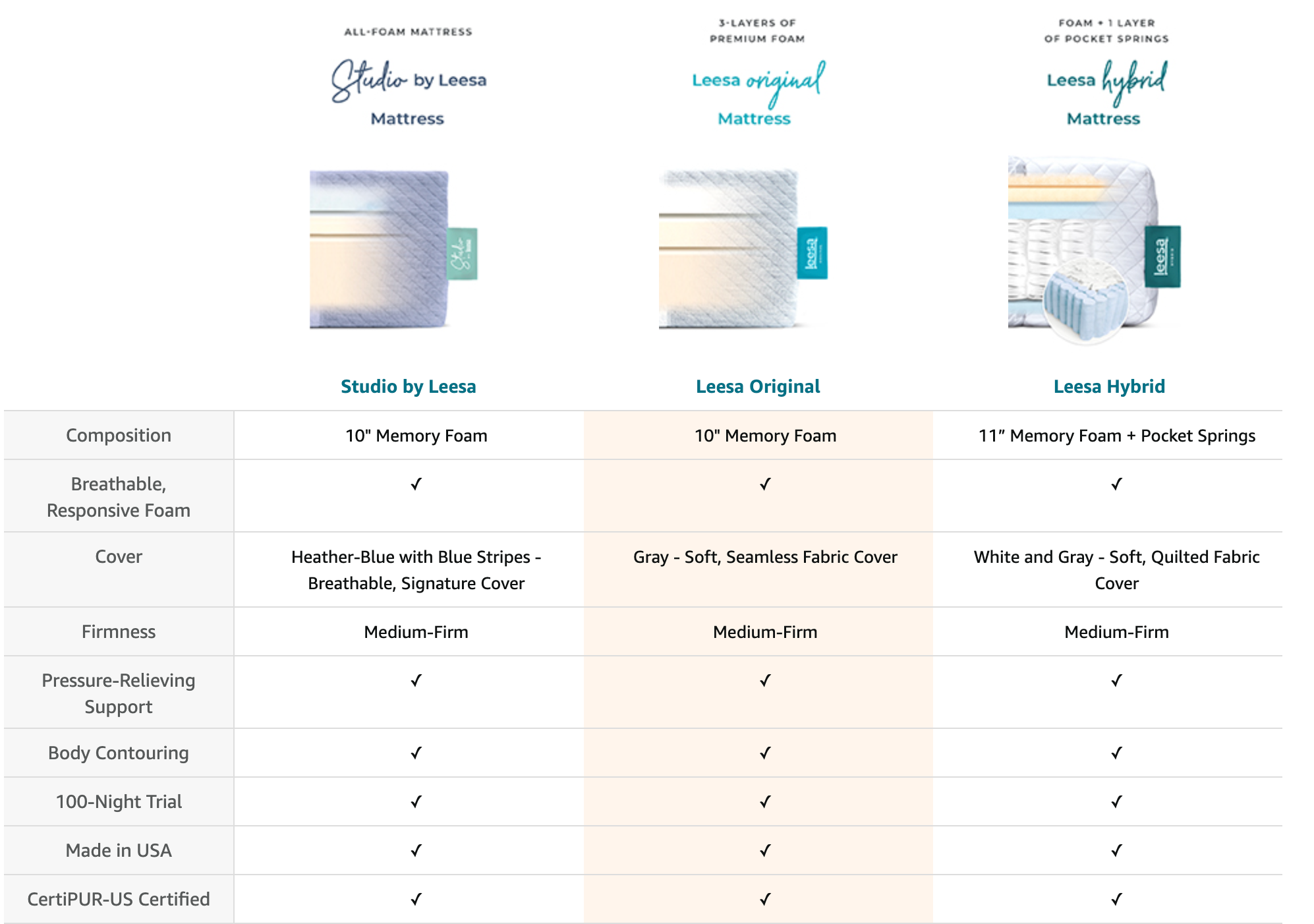

It’s not enough to simply market products. The key with multichannel is to offer native commerce opportunities across channels. It’s why Leesa offers the same robust online experience on Amazon as it does onsite, complete with a product video, social proof, and a detailed explanation of its unique value proposition:

Channel 3: Facebook

A user who still hasn’t completed the checkout process and accesses Facebook will see the mattress they left in their cart, as well as additional ads on their feed:

With a relatively high purchase price, Leesa’s Facebook ads drive consumers to its site. Your own approach might instead allow customers to purchase natively through a Facebook shop or Buy Button.

Channel 4: Pinterest

Leesa might also list and sell its products natively on Pinterest through a Buyable Pin:

LeSportsac

LeSportsac is a legacy lifestyle brand. It’s spent 40 years selling luggage, handbags, and accessories. The retailer has a multichannel approach by adding brick-and-mortar, retail partnerships, and marketplaces to its strategy.

The result:

A 20% boost in average order value

Units per order grown by 37%

A 7% increase in conversion rate

Channel 1: Ecommerce store

A branded online store is LeSportsac’s main sales channel. However, the brand found its online experience was never on-par with the experiences it delivered to in-store shoppers.

LeSportsac relaunched with Shopify Plus to solve those problems. Now, visitors to its ecommerce store are greeted with a fast-loading site, personalized shopping experience, and mobile-friendly design.

Channel 2: Brick-and-mortar stores

Alongside its DTC ecommerce store, LeSportsac has retail stores across the US, Canada, the Philippines, and Indonesia. Customers in those regions can visit a retail location to see, interact with, and buy products in the flesh.

The brand also makes its products available to buy through department stores and its own ecommerce sites. LeSportsac partners with Nordstrom and Walmart, opening up four additional sales channels for the brand and tapping into each retailer’s established customer base.

Channel 3: Marketplaces

Prefer to shop for products on marketplaces? Customers can find LeSportsac products on marketplaces like Amazon. Each product listing is optimized for search terms someone unfamiliar with the brand might search for, like “crossbody handbag in blue.”

Because Amazon forms a small part of its multichannel retail strategy (instead of its sole channel), the brand mitigates risk. LeSportsac gets the advantage of reaching Amazon’s existing customer base without building too much of its brand on rented land.

Multichannel selling software solutions

It’s easier to manage a multichannel retail strategy when you have tools replacing repetitive, time-consuming tasks.

These Shopify Plus apps were hand-selected for their quality and ability to reduce complexity in your retail business, so you can focus on growth. Each works seamlessly with Shopify Plus and has been approved at our highest technology standard:

Endear. Personalized and trackable messaging that drives revenue. Send customers SMS and email messages that nudge them toward purchasing through your sales channels.

Marsello. Create a customer loyalty program that incentivizes customers to purchase across online and offline channels.

Happy Returns. Handle customer returns through a branded online portal, regardless of which channel the item was purchased through.

Reamaze. If you’re selling across several channels, that opens up several lines of communication with your customers. Manage them using Reamaze’s all-in-one customer service dashboard.

Segments Analytics. See in-depth analytics for each sales channel in one report. Segment customers by their channel preference for personalized multichannel marketing.

Is multichannel selling right for your business?

The answer to that question depends on several factors: your business’s goals, marketing budget, and desire for control over product pricing and experiences.

Going to multichannel selling has helped retailers tap into established customer bases, reduce operational costs, and build loyalty with repeat customers. And, with processes and systems in place to manage multichannel sales, you can do most of it on autopilot.

If ecommerce is your only channel right now, dig into your existing customer data. How do shoppers discover your website? If it’s social media, Instagram Shops or Buyable Pins might be worth experimenting with. If it’s organic search, test whether listing your products on a marketplace helps you become more visible to a larger percentage of search traffic.

There is no rush to add multiple new channels to your strategy. Add one at a time. Nail the logistics of selling across several channels streamlined and go from there.

Multichannel retailing FAQ

What is meant by multichannel retailing?

Multichannel retailing is a type of retailing that involves selling products and services through multiple channels such as online, physical stores, catalogs, mobile, etc. It is a strategy used by retailers to increase their reach and customer base by allowing customers to shop in multiple ways.

What is an example of a multichannel retailing?

An example of multichannel retailing is an online retailer that has both an ecommerce website and brick-and-mortar stores. The retailer offers customers the option to purchase products online, in-store, or through a mobile app. Customers can also choose to pick-up their orders in-store or have them delivered to their home.

What is an example of a multichannel?

A multichannel example is a company that sells their products or services through multiple channels such as an online store, physical store, telephone, mail order, and email. This allows customers to purchase products or services in the way that is most convenient for them.