Holiday ecommerce sales are rising each year. Shopify Plus merchants served 17.5% more shoppers than the previous year during last year’s Black Friday Cyber Monday weekend, totalling $7.5 billion in holiday ecommerce sales.

But consumers and merchants must continue adjusting to the rapidly changing commerce landscape we’ve witnessed over the past few years. While some things have changed for the better since the pandemic, other areas of commerce have become more complex. From inflation concerns to fast and free shipping, brands should be prepared to jump through a few hoops before seeing holiday online shopping success in 2023.

Merchants all over the world are gearing up for what’s tipped to be the biggest shopping season on record. This guide shares how to stand out in 2023, complete with tips on how to increase holiday retail sales from the ecommerce businesses that are implementing them.

1. Know the 2023 online holiday shopping trends

This holiday season is different from years past. From inflation concerns to mobile ordering, modern shoppers have myriad purchasing decisions that threaten their conversion. Let’s explore how merchants can appease these anxieties this holiday season.

Inflation is a concern for holiday shoppers

Everyone is grappling with inflation, which is at its highest rate in over 40 years. Retailers are struggling to maintain healthy profit margins, pushing up the price of products. Customers—and subsequently, their spending habits—are bearing the brunt.

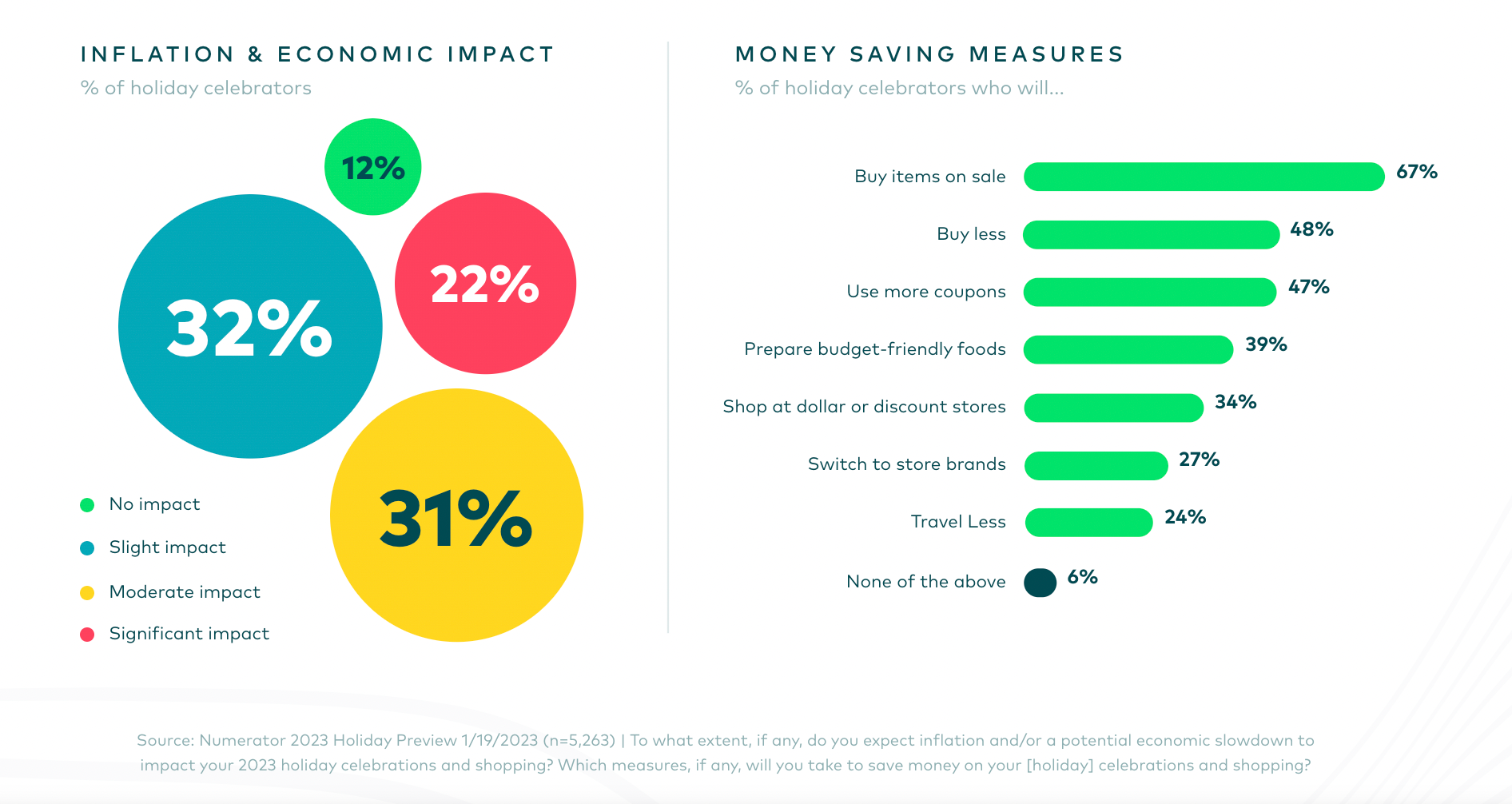

A survey by Numerator found that 88% of people think inflation will have at least some impact on their holiday spending. Data compiled in Shopify’s Future of Commerce report also found that 35% of Shopify Plus merchants have seen shrinking average cart sizes, and 50% are seeing less ecommerce site traffic and lower conversion rates.

Inflation is impacting holiday ecommerce sales.

The same Numerator study found that, this holiday season, most people will buy items on sale to combat inflation. Just under half will buy fewer products; the same amount will rely on coupons to get products for cheaper.

Buy now, pay later soars in popularity

According to a report by Afterpay and Square, three-quarters of shoppers think inflation has made it more difficult to save, opening the floor to buy now, pay later (BNPL) options. Some 21% of holiday shoppers said they’d consider a BNPL option to stretch their budget—a payment option that’s predicted to generate $17 billion in holiday ecommerce sales this year.

Cater to these shoppers this holiday season by adding BNPL options to your ecommerce store. Offer Shop Pay Installments, or integrate BNPL services like Klarna with your Shopify store to allow shoppers to spread the cost of their purchase and pay in installments. You’ll still get paid upfront in full by the BNPL provider, so it’s a no-brainer to help your customers spread the cost of their holiday purchases.

Holiday ecommerce sales go mobile

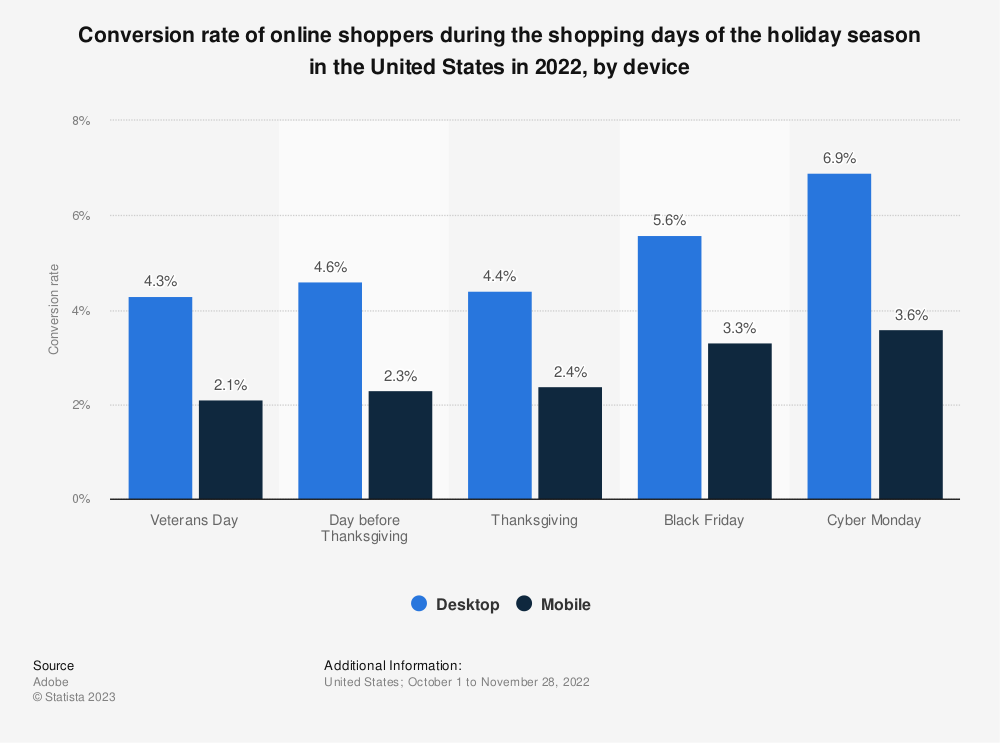

Last holiday season, almost three-quarters of BFCM sales by brands on Shopify happened via mobile. But while mobile users had a higher add-to-cart rate on Black Friday, Statista reports mobile shoppers had a much lower conversion rate than their desktop counterparts across the four biggest shopping days.

Mobile conversion rates are down across the board.

Set your ecommerce store up for success—and convert mobile shoppers who add products to their online cart—by optimizing your site for mobile. Prioritize the experience for mobile shoppers with finger-friendly buttons, accepting mobile payments (like digital wallets), and placing important information above the fold.

2. Prepare for Black Friday and Cyber Monday earlier

The Black Friday Cyber Monday weekend might only be four days long, but preparation starts long before Thanksgiving—especially for Gen Z consumers, who have already started their holiday shopping earlier than last year. Here are three techniques to prepare your ecommerce brand and maximize sales once the weekend arrives.

Plan key shopping dates

Black Friday tends to overshadow the holiday season. While the Friday following Thanksgiving is the biggest shopping day of the year accounting for 40% of all holiday retail traffic, there are other prime shopping days throughout the holiday season that are also worthy of attention.

Plan key shopping dates in advance so you know exactly what’s coming up and when people buy. It’s the best way to prepare your online store for peak shopping days—not just Black Friday.

2023’s holiday calendar includes:

Single’s Day: November 11

Small Business Saturday: November 25

Cyber Monday: November: November 27

Giving Tuesday: November 28

Green Monday: December 11

Christmas Eve: December 24

Boxing Day: December 26

New Year’s Eve: December 31

Black Friday is the most popular shopping day of the year. Source: Statista

Create a promotions calendar

Once you’ve got peak shopping days in your diary, work backward to drive sales and promotions that attract customers in the mood to buy. Use a calendar tool to detail each promotion’s:

Start and end dates

Coupon, discount, or deal

Product or categories on offer

Qualifying criteria (e.g., orders over $100)

Assets and creatives

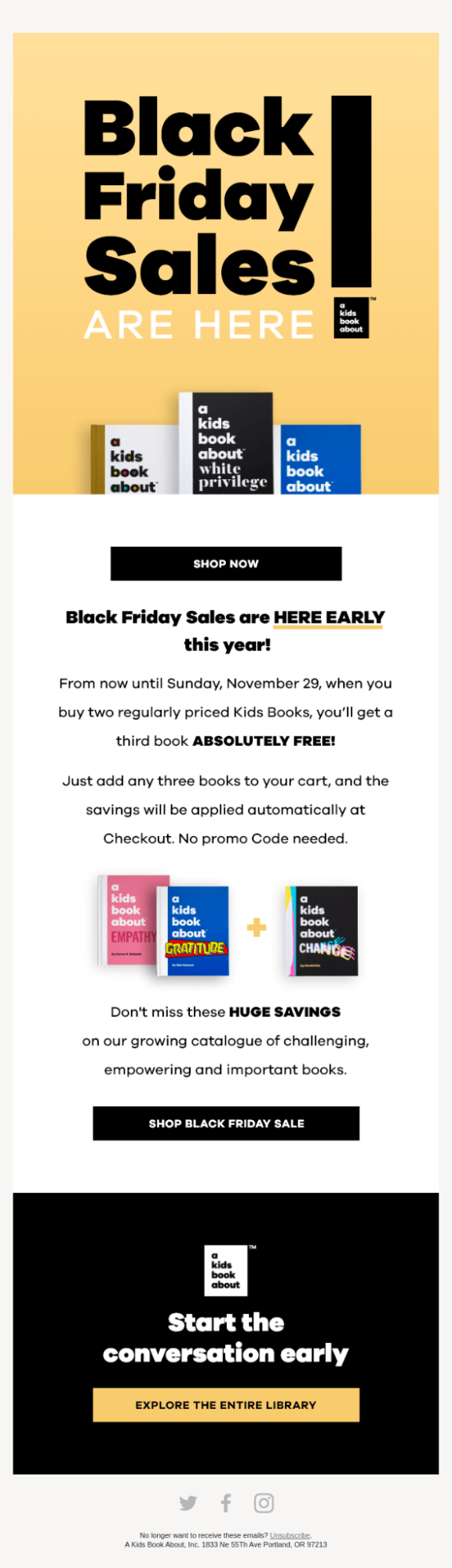

Promotions don’t have to be limited to the day you’re celebrating. A Kids Co., for example, ran an early Black Friday deal. Shoppers got superb deals earlier than the official date, making Black Friday a week-long shopping event, rather than a single day of sales.

A Kids Co. launches its Black Friday sale early. Source: Really Good Emails.

Forecast demand and plan inventory

Inventory management is notoriously difficult to handle year-round. But it becomes even more of a challenge throughout the holiday season, when consumer demand changes by the day.

“Last year, like many other businesses, we ran into many problems with inventory management when demand went up unexpectedly,” says Priyanka Swamy, founder and CEO of Perfect Locks. “It was a real wake-up call about how important it is to forecast accurately and keep your supply chain flexible. So this year, we’ve got a strong inventory management system that works well with Shopify Plus, so we can keep an eye on sales and adjust stock levels right away to ensure we’re meeting customer demand without running out.”

Use demand and supply chain forecasting tools like Inventoro to accurately estimate demand this holiday season. These tools use artificial intelligence to interpret weather trends, social media data, and market intelligence to predict how many units you’ll need for each product. Stock up in advance and prevent holiday stock outs from driving 41% of potential customers toward a competitor.

3. Create a smooth customer experience

Now that holiday shoppers are bombarded with marketing campaigns from new brands that promise them the world, there’s never been a better time to level up your customer experience.

Optimize the checkout

The holiday season isn’t just busy for sales. People are rushing to find holiday gifts and prepare for Christmas. Now more than ever, they don’t have time to waste. Anything a customer buys online needs to be an easy, quick, and simple process—including the checkout experience.

Optimize your checkout process by:

Enabling one-page checkout

Adding social proof or trust signals

Upselling or cross-selling related products

Accepting multiple payment options

Offering guest checkout

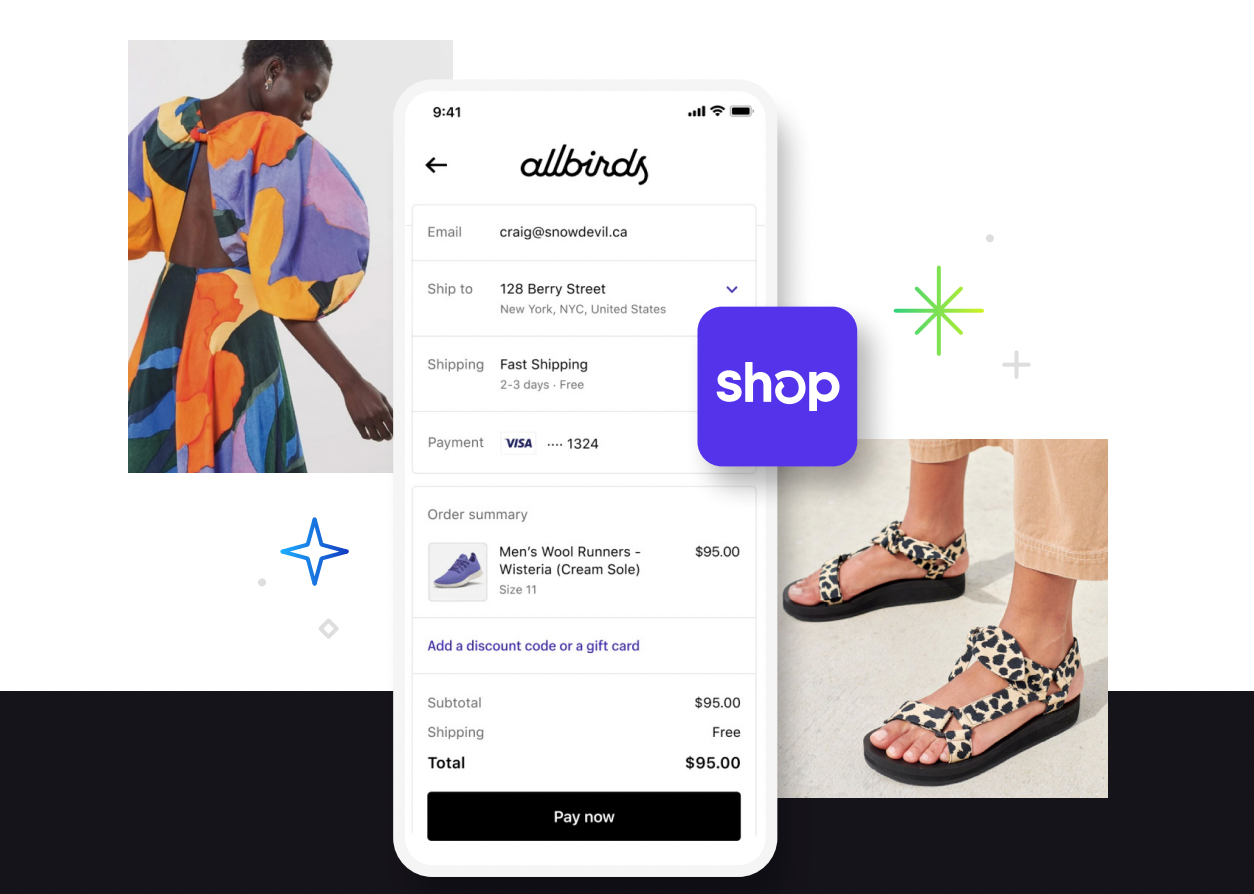

Even better: let customers purchase in a single click with Shop Pay. Whenever they buy from a store with Shop Pay enabled, they can sign into their account and breeze through the checkout process with a single click. It’s no wonder Shop Pay has a 1.43 times better conversion rate and 1.22 times faster time to check out than non–Shop Pay buyers.

Shop Pay is the world’s best-converting checkout.

Offer live chat options

You’ve done the hard task of driving a holiday shopper toward your online store. They’ve found a product they’re interested in, but they have a question that’s holding them back. A live chat feature—that’s available on both the product page and checkout page—can give them real-time answers and improve site conversion rates.

“To increase holiday ecommerce sales this year, we focus on creating a seamless customer experience,” says Ricky Allen, marketing director at Ever Wallpaper. “We have implemented a chatbot on our website to provide instant customer support and answer any queries they may have.”

Use Shopify Inbox to create an automated chatbot that answers FAQs in seconds, rather than losing potential shoppers by forcing them to wait for a support rep. From holiday returns policies to shipping queries, you’ll filter out any repetitive questions and give your team enough bandwidth to focus on more complex support tickets that need a human touch.

Add video to product pages

There are several key elements of any high-converting product page: a title, a description, and a photo of the product you’re selling. Add product videos into the mix and reach the 89% of people who’ve been convinced to buy a brand’s product after watching a video. It’s a strategy with the potential to reduce holiday returns, too—some 22% of online-bought items are later returned because the product looked different in the flesh.

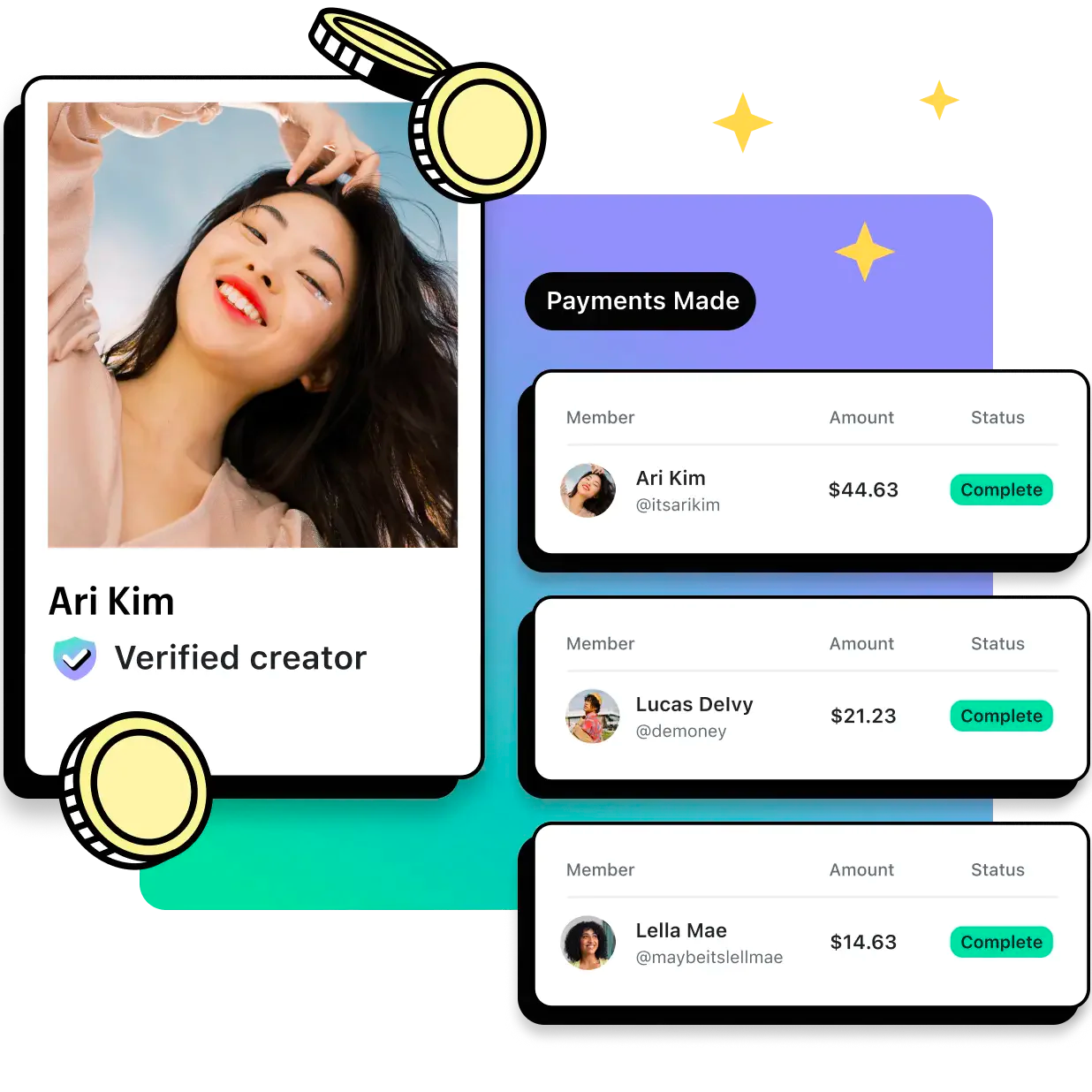

Enlist the help of creators to produce high-quality videos to give the illusion of user-generated content. Instead of fishing through low-quality videos from ordinary customers with no marketing experience, you’ll leverage skills from a creator who produces UGC for a living.

Manage your creator strategy with Shopify Collabs. You can find creators, send free samples, pay creators, and manage assets without leaving your Shopify dashboard.

Manage creator partnerships with Shopify Collabs.

Update your holiday returns policy

An influx of ecommerce holiday sales can lull brands into a false sense of security. You might have raked in thousands over BFCM, but come January, holiday returns skyrocket from 16% to almost 18%, meaning less profit than you originally imagined.

Update your holiday returns policy to insulate your ecommerce brand against return fraud, which is also rife throughout the holiday season. It will prevent people from returning items that have been:

Stolen

Purchased with stolen credit card

Bought in a sale but the customer expects a full refund due to a “lost receipt”

Never intended to keep (especially common with clothing, whereby the purchaser keeps the tag on their product, wears it, and returns it for a full refund)

Returns for legitimate customers can also get confusing throughout the holiday season. If a shopper is buying a Christmas gift on Black Friday and your traditional returns window is just 30 days, they’re taking a risk. If the recipient doesn’t like their gift, they’re stuck with no option to return it.

While it might sound counterintuitive to showcase your returns policy to holiday shoppers, it can improve the returns experience for legitimate customers and deter fraudsters from targeting your brand. Consider extending the returns period, but be strict on what can be returned, how customers can process a return, and how long they have to return it—all of which can reduce ecommerce fraud and limit refunds when the holiday season comes to a close.

4. Use social commerce platforms for more holiday ecommerce sales

Social media is no longer just a place for a brand to showcase its holiday spirit. Instead, it’s now a must-try strategy to drive holiday ecommerce sales, boost engagement, and focus on customer care.

Meta: Facebook and Instagram

Some 62% of US social buyers said their most recent social purchase was on Facebook, making this platform a major player throughout the holiday season.

To prove the purchasing power of its various platforms, Meta—which operates both Facebook and Instagram—is offering several ways for you to make your mark on holiday ecommerce sales this year:

Instagram and Facebook Shops lets you create an in-app storefront and tag products in social media content to transform your visual posts into an immersive shopping experience.

With Facebook Page posts, you can launch ads and promote page posts right inside Shopify.

Facebook Checkout with Shop Pay offers customers a new seamless checkout experience on Facebook and Instagram. Merchants can manage payments along with orders and returns and benefit from promotions, faster order syncing, and more.

Meta also makes it easy for you to take advantage of this trend by creating meaningful connections with customers using its messaging features on Messenger, Instagram, and WhatsApp. Brands can utilize ads that click to message to engage (or re-engage) with people whenever and wherever they choose.

The Shrine runs Black Friday Facebook ads to capture social buyers.

Google and YouTube

Consumers shop across Google more than a billion times per day. Google has invested heavily in integrated shopping experiences to show you how to meet your customers where they already are—including Google Lens.

Picture this: A consumer screenshots of a pair of shoes they’re coveting on an influencer’s feet. Later that week, when they come across that screenshot in Google Photos, there’s a suggestion to search for the photo with Lens. This innovation lets the customer see shoppable search results that help them find that pair of kicks that caught their eye and seamlessly complete the purchase.

The Google & YouTube app for Shopify gives you another way to get in front of interested shoppers, by listing your products for free or running paid Performance Max campaigns directly inside your Shopify admin. This collaboration lets your product listing ads be discoverable to high-intent consumers across all Google-owned properties, including Google Search, Shopping, Images, and YouTube.

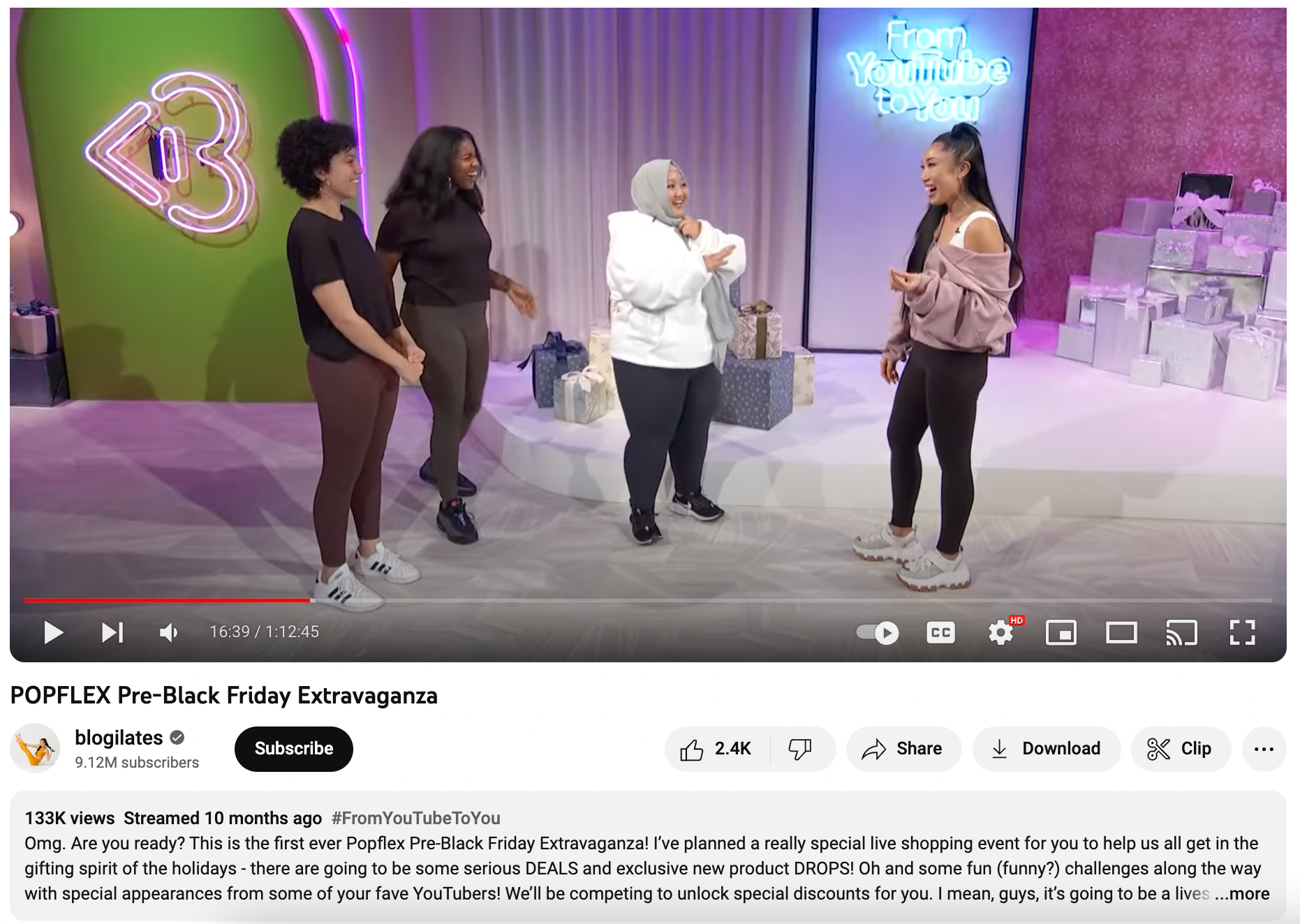

POPFLEX is an activewear brand that uses YouTube Shopping to create authentic live shopping experiences. It sells passively by pinning products next to on-demand videos, so followers can like, subscribe, and buy without exiting YouTube. Last November, a single Black Friday livestream contributed to its second-highest sales hour of the year.

POPFLEX’s livestream was a roaring success. Source: YouTube

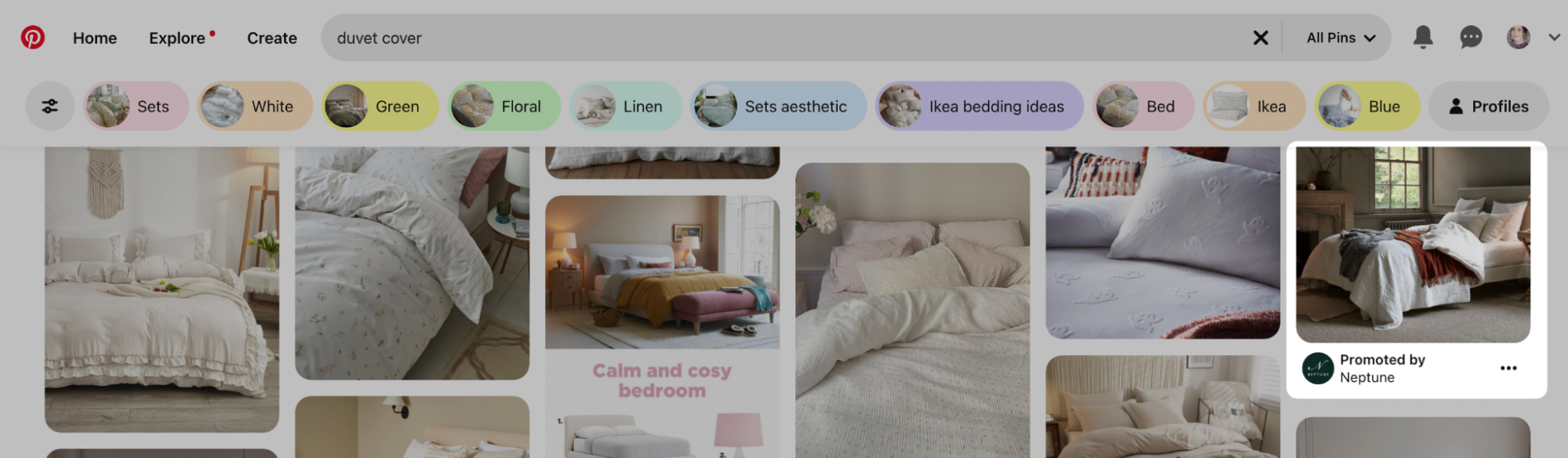

Pinterest is a search engine–social media hybrid where users pin products to virtual pinboards. Of its 465 million users, some 80% of weekly pinners have discovered a new brand or product on the platform. Pinterest reports its users spend two times more per month than people on other social media sites.

With Shopify’s Pinterest sales channel, you can expand your reach by positioning your products in front of millions of consumers on Pinterest during the busiest shopping days this year. Turn your product images into pins and allow Pinterest users to find, save, and buy products from your website, without any advertising cost. According to Pinterest, this can help you get five times more impressions than merchants who haven’t added their products.

Take this one step further by investing in sponsored Pins through the Shopify Pinterest channel. This product pin from Neptune Home, for example, appears in the search results for “duvet cover”:

Neptune’s ad appears in relevant Pinterest search results.

TikTok

The hashtag #TikTokMadeMeBuyIt currently has more than 70 billion views on the app. Compared to other platforms, TikTok users are 1.5 times more likely to purchase products they discover through the app, making it a social commerce powerhouse that you shouldn’t ignore during this holiday online shopping cycle.

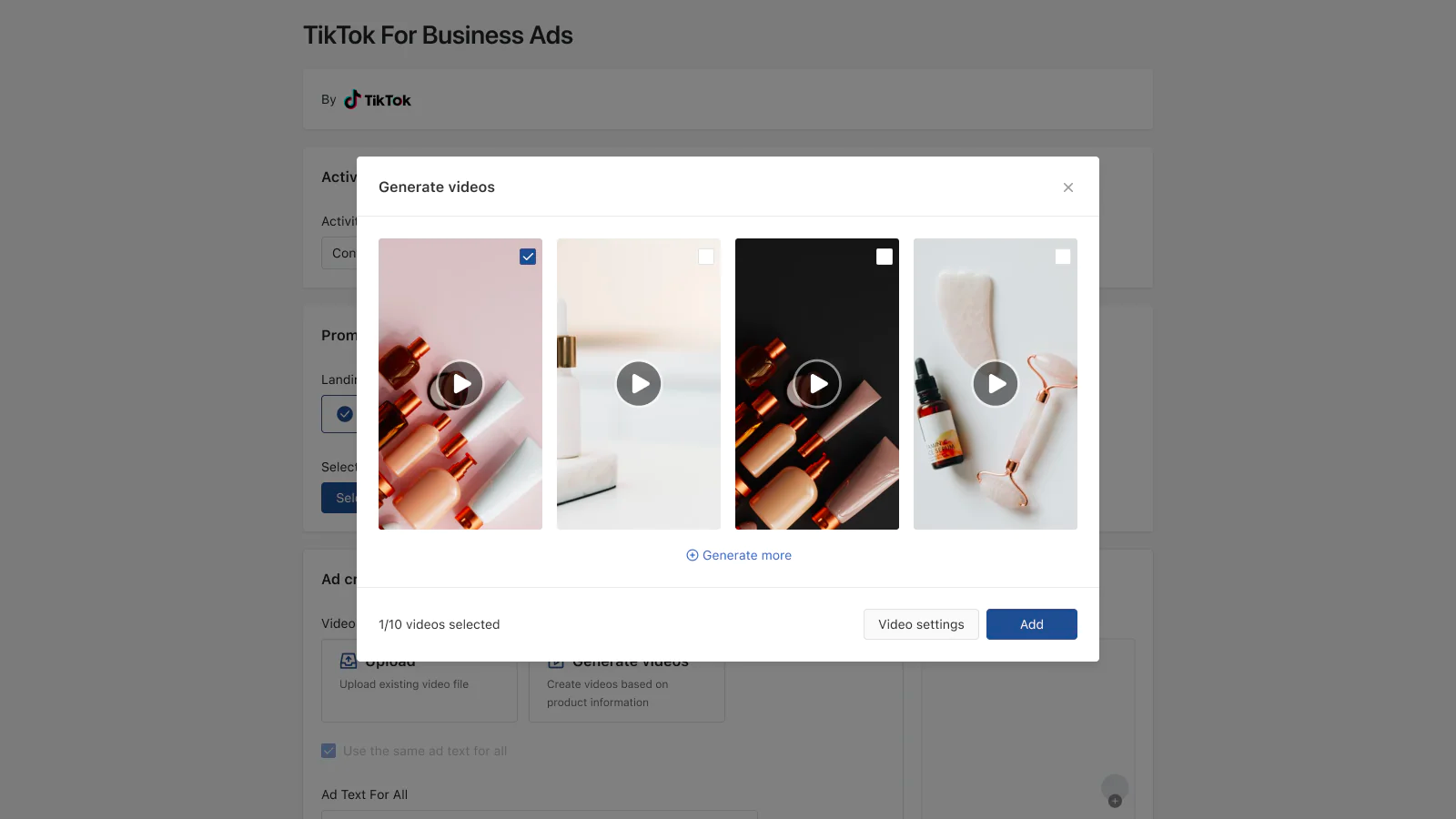

TikTok’s Shopify app lets you create video ads, track results, and manage your orders from your Shopify admin. Key features available on the TikTok channel for Shopify include:

TikTok Ads: Merchants can start with TikTok For Business and start running ads quickly for their holiday online shopping programs.

TikTok Shopping: Shopify’s guided campaign-creation tool assists you in setting up and tracking conversion campaigns and promoting your holiday deals effortlessly.

Creative Made Simple: Create TikTok-style videos from existing product imagery in minutes, requiring no video production expertise.

The TikTok Shopify app.

X (formerly Twitter)

A Twitter survey revealed that 76% of people agree that conversations on Twitter result in a product purchase. And with 353.9 million active users, merchants that want to increase their reach during the upcoming online holiday shopping season should take notice.

With the Twitter sales channel on Shopify, US-based merchants can connect their Shopify catalog with Twitter Shopping seamlessly to get their products in front of millions who have conversations on Twitter for free. Twitter Shop lets you showcase up to 50 products on your Twitter profile and spotlight up to five products using the carousel.

Trixie Cosmetics (a brand under influencer Trixie Mattel) adopted the Shopify Twitter sales channel early. Because of that, this merchant has seen its online sales from Twitter grow by 725%.

Trixie Cosmetics’ Twitter Shop.

5. Optimize your holiday marketing and campaigns for discovery

There’s more to a holiday marketing strategy than pushing a discount code across every marketing channel you’re using. Here’s how to craft campaigns that stand out and push potential customers toward your online store.

Retarget shoppers with email marketing

For every $1 large companies spend on email marketing, they make around $10 in sales. But a customers’ inbox is a competitive space throughout the holiday season. Campaign Monitor discovered that last year, ecommerce brands sent 116.5 million Black Friday emails and 106 million Cyber Monday emails.

Create BFCM email segments to personalize your campaigns and stand out in a customer’s inbox. That includes:

Email ignorers

VIP customers

Product browsers

Category buyers

Gender-based segments

Seasonal shoppers

Combine this strategy with automated cart recovery emails that online retailers use to recoup up to $60 million in otherwise lost sales.

“We’re launching a series of engaging email marketing campaigns to drive repeated visits and foster customer loyalty,” says Wendy Wang, owner of F&J Outdoors. “By sharing useful tips on maintaining outdoor furniture and making the most of our products, we aim to deepen relationships with our customers and incentivize repeat purchases.”

Lean into holiday gifting initiatives

Solving a pain point for your consumers, like making it easier to find and purchase unique gifts online, goes a long way toward building customer loyalty that can last far beyond the 2023 holiday season.

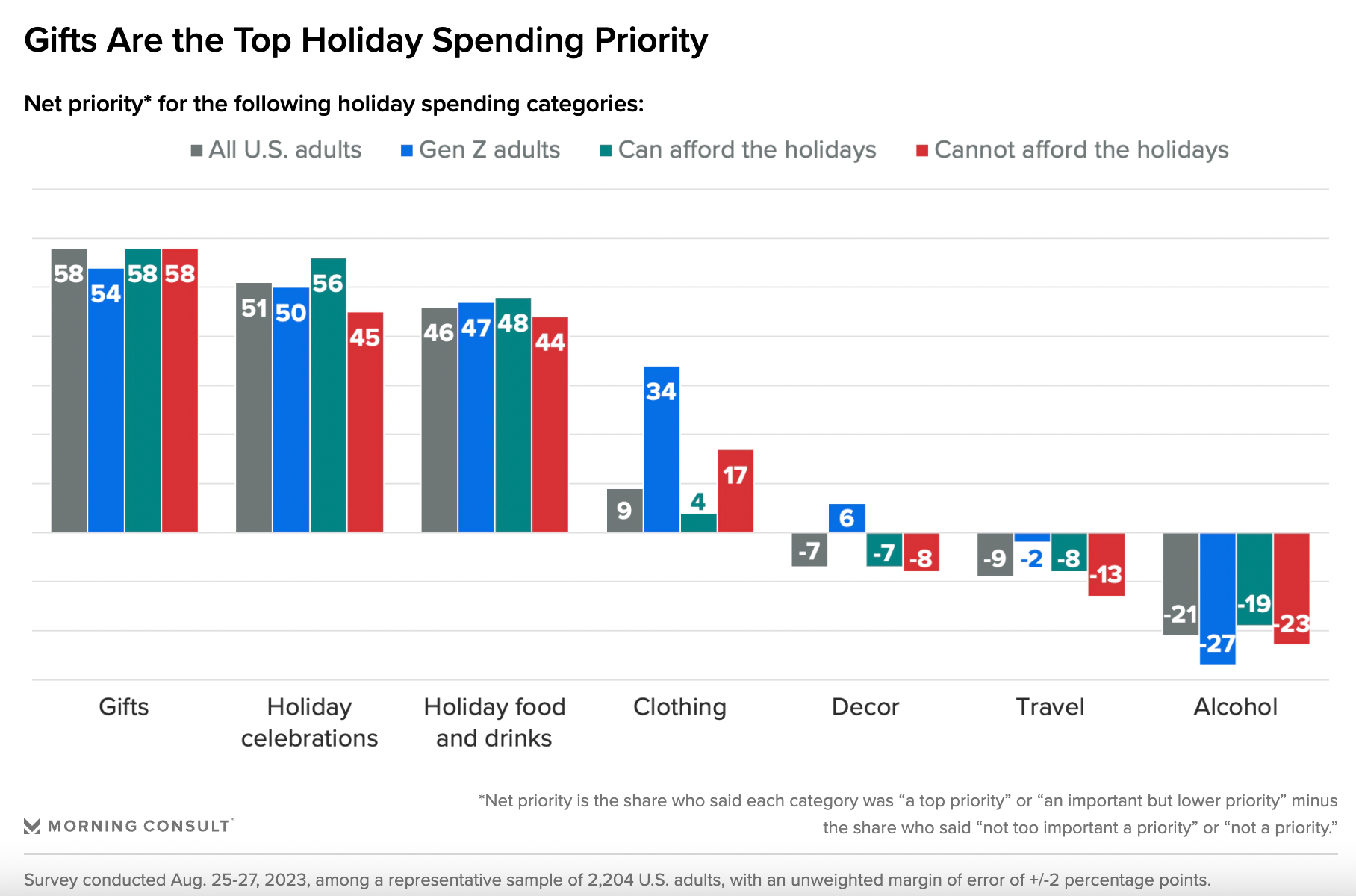

Gifts are the top holiday spending priority for shoppers, beating holiday food, drinks, or clothing. Help potential customers find the perfect gift with a gift guide—a collection of products that make ideal gifts for the loved ones in a customer’s life. Create landing pages for each gift guide that is tailored toward each buyer persona. If you’re a skin care retailer, for example, create a gift guide for moms that collates your bestselling products amongst moms.

Holiday gifts are the top priority amongst all shoppers.

Spread the holiday spirit and let your customers be the recipient of a gift for extra attention and customer loyalty. Whether it’s a free product or a gift card to redeem on their next order, these unexpected gifts could turn holiday shoppers into year-round customers.

“One major thing we are doing this year is running a contest,” says Alex McIntosh, CEO and co-founder of Thrive Natural Care. “One of our skin care kits sold between Black Friday and December 15 will have a ‘golden ticket’ hidden inside. The person that finds this ticket will win a trip to Costa Rica. We are amplifying this promotion by allowing our email subscribers the opportunity to give their friends and family a 25% discount on kit purchases, so the barrier to entry in the contest is much lower."

Invest in live commerce

Live commerce is blowing up. Some 20% of shoppers in the US participated in a live shopping event last year—the vast majority of whom join a brand’s stream to get exclusive offers and discounts.

Social-first approaches—including behind-the-scenes livestreams, video consultations, and personalized product recommendations—are ways your brand can capitalize on the video trend this holiday online shopping season.

Not only can it help you stand out and strengthen customer relationships, but some early adopters of livestream selling have reported conversion rates of up to 30% (a whopping 10 times higher than conventional commerce conversion rates).

Gather first-party data to combat rising advertising costs

Apple’s introduction of app tracking transparency (ATT) left many merchants scrambling for new advertising methods. Any app within the App Store that collects data about end users and shares it with other companies needs to give users a choice of whether or not they want to be tracked across apps and websites owned by other organizations.

ATT turned the mobile marketing space upside down, forcing brands to do without the user-level data they’ve come to rely on. And for many, digital ad campaign performance has suffered. Advertisers lost 30% accuracy on targeting algorithms, which led to $10 billion in ad revenue losses.

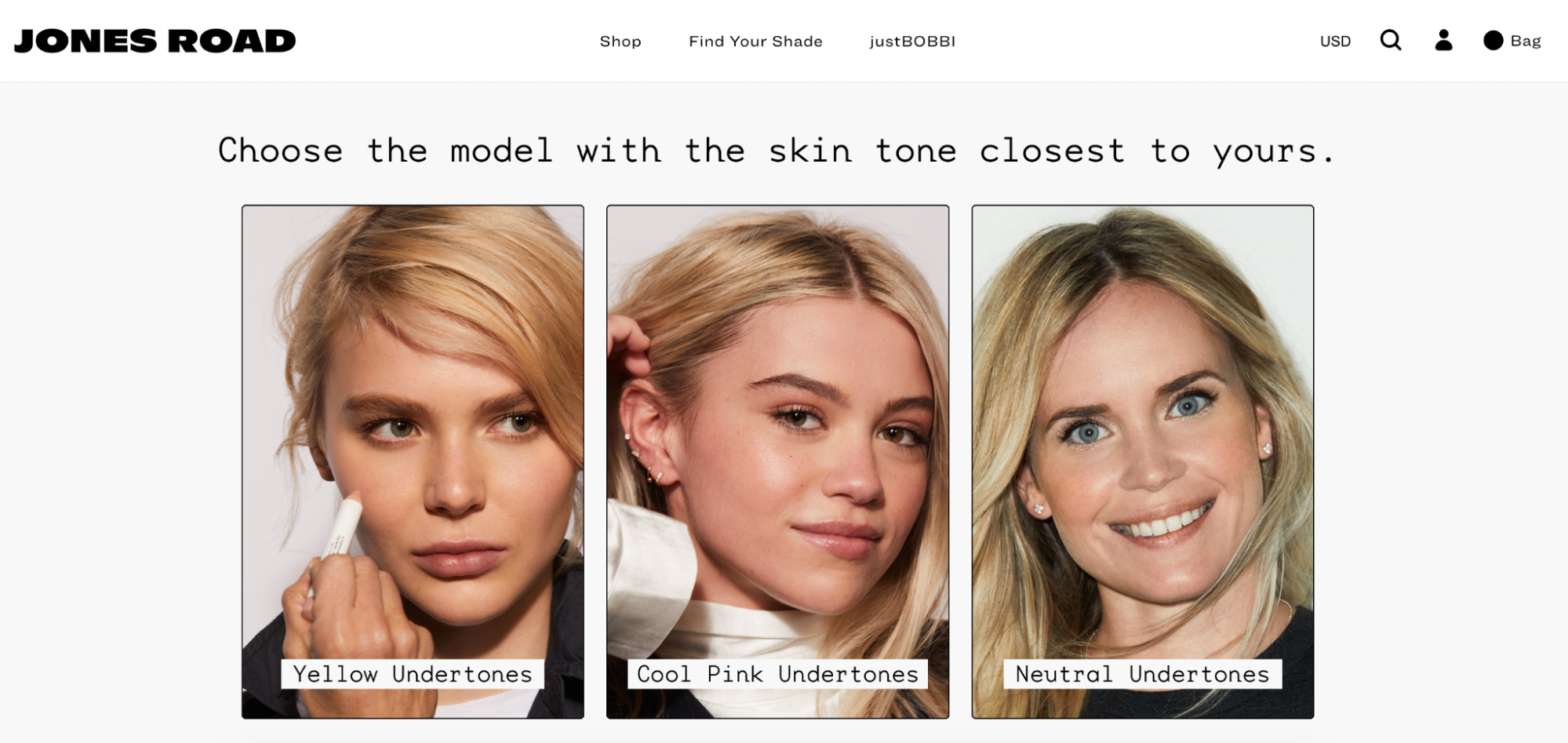

Savvy brands are coming up with creative ways to get around this, including Jones Road Beauty, a cosmetics retailer that is leaning on quizzes to provide personalized product recommendations. In the process, the brand gathers holiday season first-party data for further retargeting. It could run holiday email marketing campaigns specific to each customer’s skin tone, preferred product, and skin concern.

Jones Road Beauty’s quiz.

“Our customers will be the loudest voice in our holiday campaigns,” says Michael Klein, founder and CEO of Herbaly. “Through A/B testing, we learned that when our marketing efforts are grounded in anecdotes from the customer experience, we see more sales and a stronger connection between our brand and customers.”

6. Make shipping and fulfillment easy to improve conversion rate

Merchants on Shopify Plus exceeded the average ecommerce conversion rate of less than 4% throughout last year’s holiday season, converting 7.38% of all holiday shoppers. Many of them focused on shipping and fulfillment initiatives to make that possible.

Set free shipping thresholds

Two-thirds of modern customers expect free shipping on all online orders, driven largely by Amazon’s commitment to free, fast delivery with Prime. Eighty-four percent of Shopify Plus merchants met these expectations and offered free shipping throughout the holidays last year.

While free shipping allows you to tempt new customers into buying from your store, there’s a small risk of sabotaging any profits you’d ordinarily make on each order—especially if it’s a low value order. Absorbing a $5 ecommerce shipping cost can significantly drive down profit margins on a $10 product.

Implement thresholds that every order has to meet in order to qualify for free shipping, such as orders over $50. Alongside making sure there’s enough profit in each order, thresholds are a tactic proven to increase average order values.

Offer expedited shipping

Next-day shipping is no longer enough to impress holiday shoppers. Offer expedited shipping—the fastest possible way to get your product into a customer’s hands—as a premium option for last-minute holiday shoppers who don’t have time to wait.

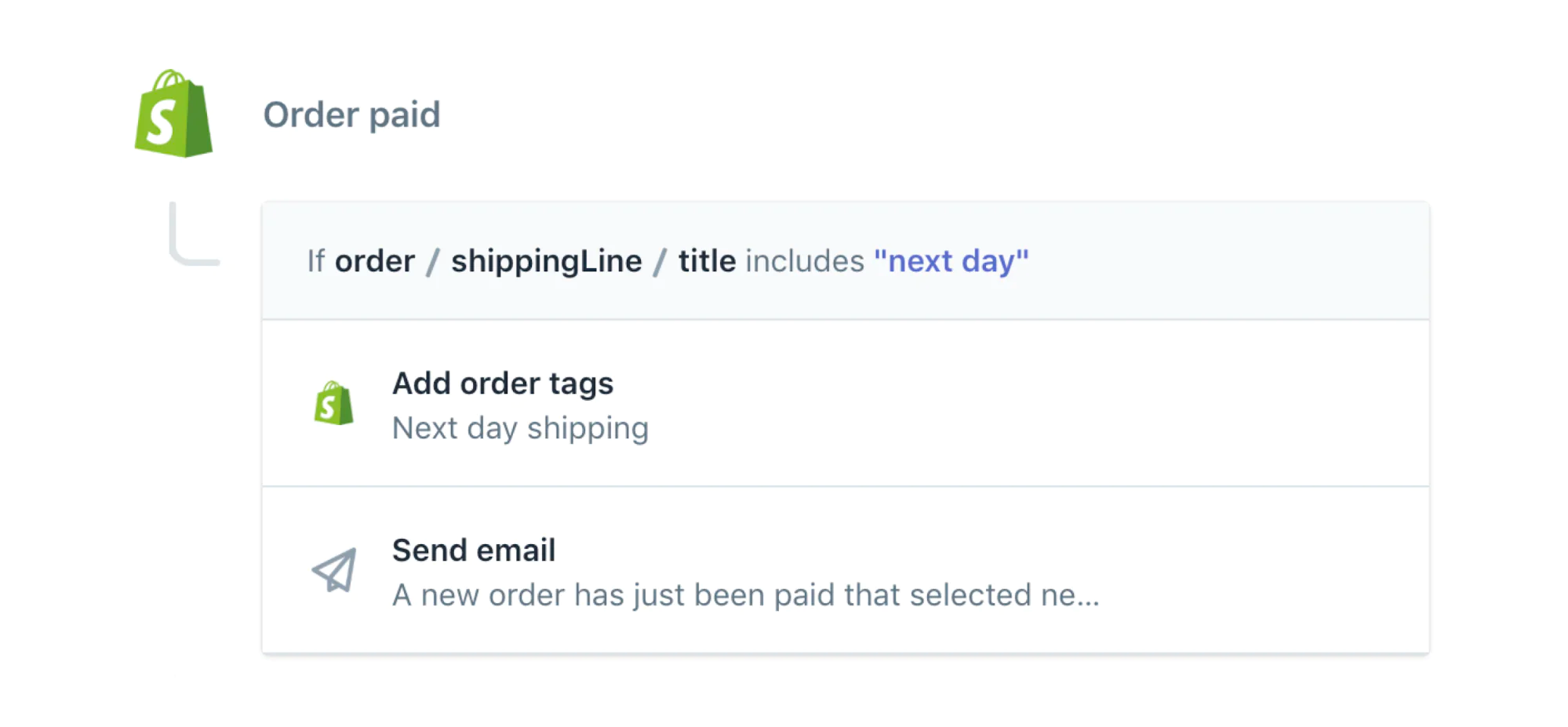

Lean on Shopify Flow to automate ecommerce workflows that tag orders with the expedited shipping option checked. Your fulfillment team will get notified when new orders come through from customers who paid extra for quick shipping, helping you to prioritize those transactions when fulfilling holiday orders.

Shopify Flow automation for orders with next-day delivery.

Offer local pickup and delivery

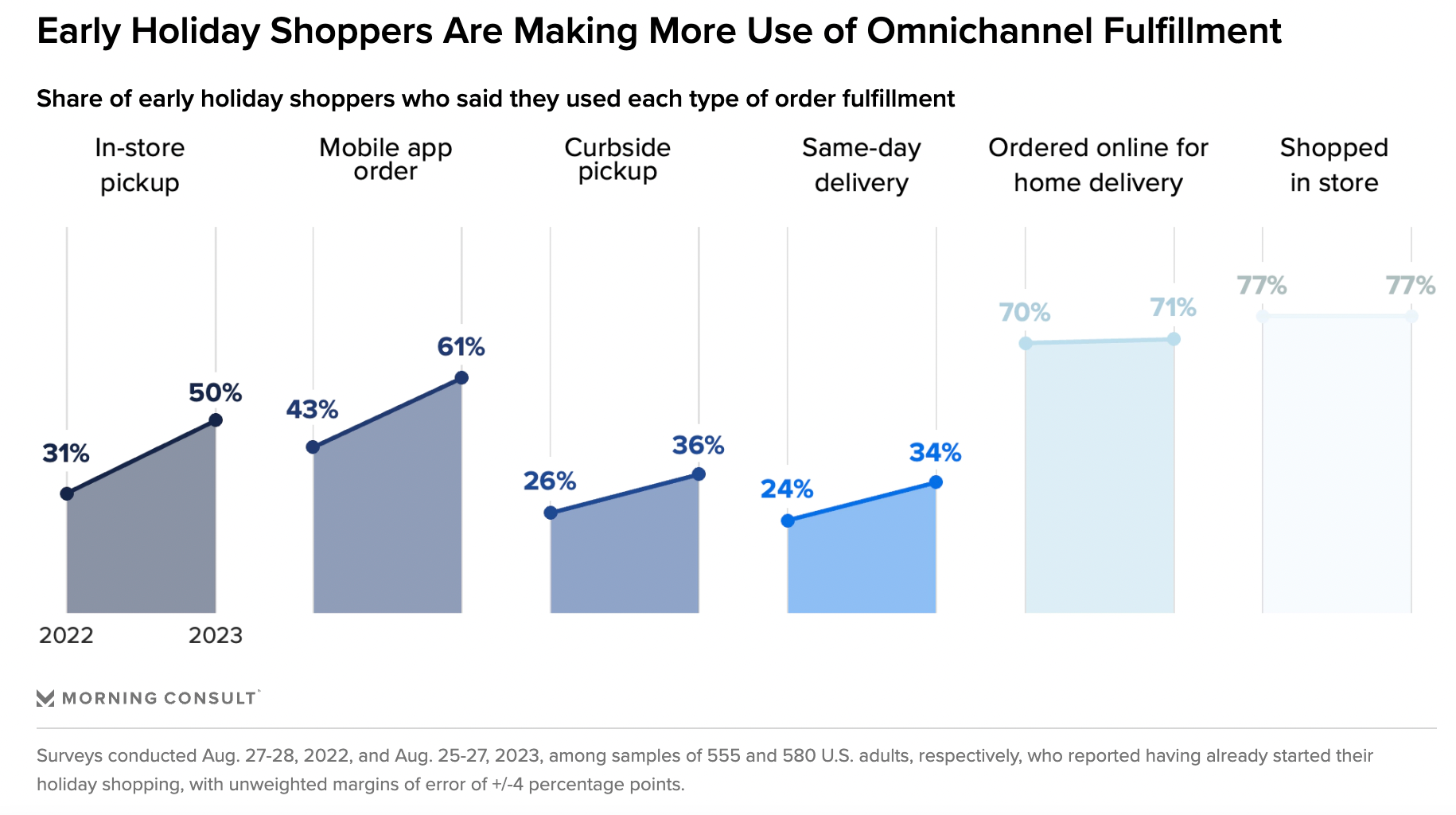

While the majority (57%) of holiday sales happen online, offline channels like brick-and-mortar retail still have a stronghold on holiday shoppers. Studies show that online shoppers opt for omnichannel fulfillment options when placing orders throughout the holiday season.

Lean into this holiday ecommerce trend by offering buy online, pickup in-store (BOPIS) and curbside pickup on holiday orders. You’ll take the pressure off your fulfillment team, save on shipping costs, and help holiday shoppers get their orders faster than waiting for them to arrive in the mail. There’s also the added bonus of people making additional impulse purchases when they come to collect their order from your store.

Holiday shoppers take advantage of omnichannel fulfillment options.

Outsource to a third-party logistics provider

Shipping and fulfillment can get complex throughout the holiday season. You’ve got orders coming in from a variety of sales channels. And considering 85% of customers would be deterred from buying more products from a retailer they’d had a negative shipping experience with, you’ve got little room for error in an already-testing time of year.

Consider enlisting the help of a third-party logistics provider like Shopify Fulfillment Network (SFN). Ship your products to a Shopify warehouse. Any new orders made through your online store or integrated sales channels will get routed to the warehouse where workers will pick, pack, and ship orders directly to holiday shoppers.

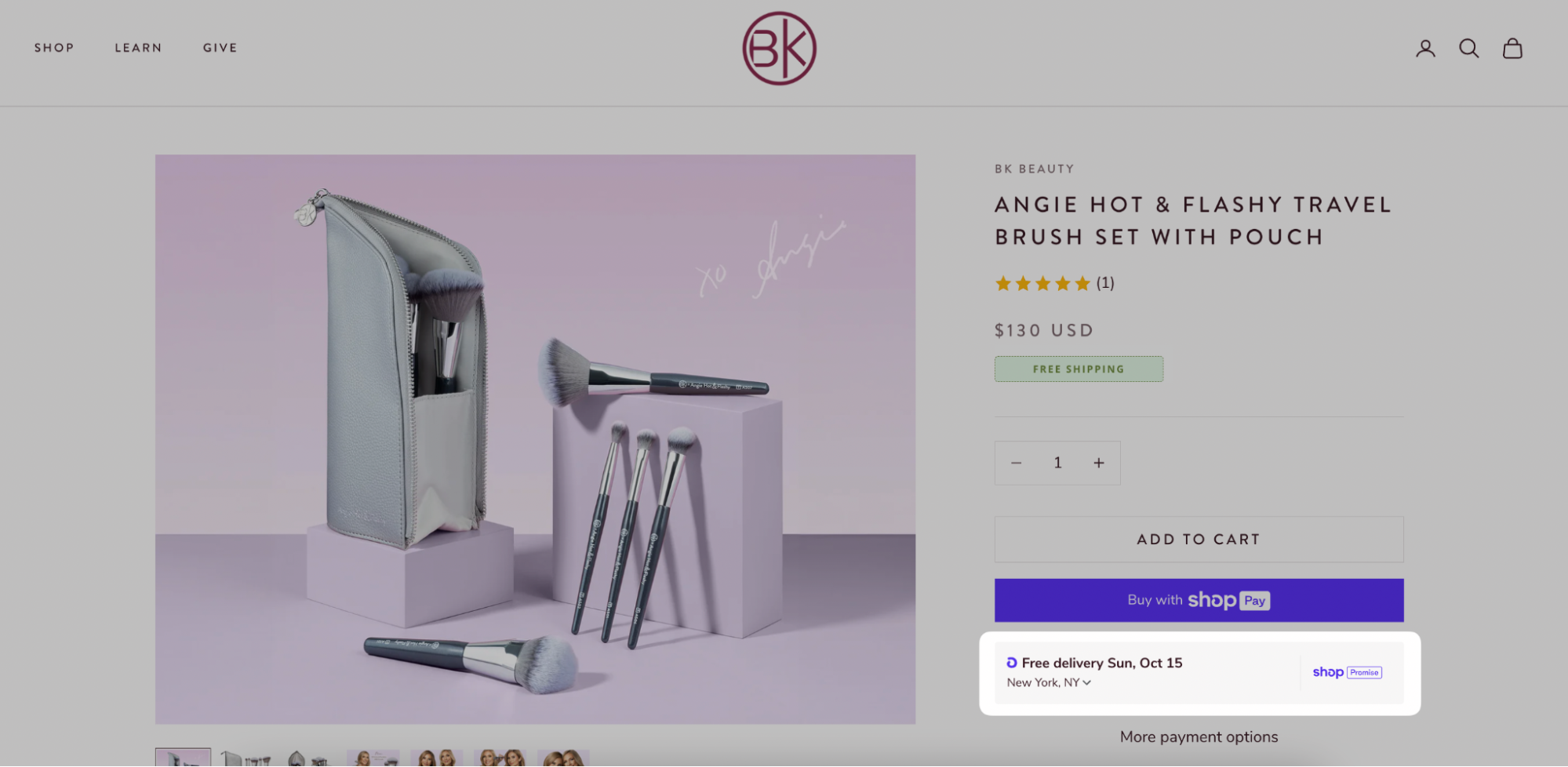

BK Beauty uses Shop Promise to guarantee delivery dates to online shoppers.

Orders fulfilled through SFN also get access to Shop Promise—a delivery badge that promises customers will get their order within a specified time frame. Should the SFN miss this deadline, you’re covered with a limited guarantee from Shop, whereby shipping fees are covered at no extra cost to you. This element alone has been proven to increase conversions by up to 25% on product pages.

Consider automation software

Ecommerce operators have lots of plates to spin throughout the holiday season. Make sure no task (or customer) is left behind by enlisting the help of ecommerce automation software.

Shopify Flow allows you to create automated workflows with “trigger, condition, and action” rules. In other words: When someone completes a trigger (like changing inventory quantities), the rule checks whether a condition has been met (like whether it falls below 50 units). If it has, it’ll proceed and complete an action (like emailing your buying team to notify them of low stock).

Other smart ways to leverage ecommerce automation templates to capture holiday ecommerce sales include:

Tagging your VIP customers when they reach a certain spend

Manually flagging high-risk orders so your team can review them and block fraudulent transactions

Hide and republish product pages when an item goes in and out of stock

Capture holiday ecommerce sales this year

The secret to making this holiday season a success is preparation, beating customer expectations, and making it a no-brainer to buy from your online store.

A measly 10% discount is not enough to stand out amongst a sea of brands trying to lure new shoppers in with bigger and better deals. Whether it’s a free gift with every purchase or fast shipping, use these techniques to craft engaging holiday campaigns that help you stand out.

You’ll not only rake in more sales this year, but retain profits when the inevitable January returns frenzy happens.

Holiday ecommerce sales FAQ

What are the best sales months in ecommerce?

November and December are the biggest sales months of the year. Studies predict that consumers spend $960 billion in these two months alone. That averages out at $883 per shopper.

What holiday has the most retail sales?

Black Friday, which happens on the Friday immediately following Thanksgiving, is the day with the highest online retail sales. More than half of shoppers buy holiday presents on this day alone.

How much holiday shopping is done online?

In 2022, some 57% of holiday shopping happened online, compared to 43% in-store.

What are the busiest ecommerce days of the year?

Singles’s Day, Black Friday, Small Business Saturday, and Cyber Monday are the biggest ecommerce days of the year. They all happen in November and December.

Read more

- Home Furnishing Ecommerce Sites: 15 Lessons from the Best in a $258B Market

- Health Ecommerce: Serving and Selling Wellness in a Jaded Online World

- Direct-to-Consumer Business Model in CPG: How-To Guide for Brand Managers

- 4 Trends for Commerce from Mary Meeker’s COVID-19 Internet Trends Report

- The 9 Biggest Consumer Behavior Trends That Will Shape 2023

- The Future of Labor Rights in Fashion’s Supply Chain

- Where Global Business is Going in the Wake of COVID-19

- Best Ecommerce Articles of 2018 with 10 Lessons to Guide You into the New Year

- How Knixwear, Allbirds, and More Brands Are Showing Support During COVID-19

- New York Fashion Week 2020 Trends: Sustainability, Made-to-Order and Off-Runway