Many people have hobbies—pastimes where you dedicate some of your spare hours to activities they find fun or fulfilling.

While you probably didn’t get into your favorite hobby to make money, you can still turn it into a side hustle or thriving business that generates a stream of income. Depending on how you direct your talents and interests, you can make anything from extra spending money to a full income through an online business centered around your hobby—all by doing something you might have done anyway.

This guide compiles a list of common lucrative hobbies that can make money.

12 profitable hobbies that make money

- Writing

- Creating illustrations and designs

- Making music

- Cooking

- Gardening

- Doing photography

- Producing DIY crafts

- Performing comedy

- Drinking (and knowing about) coffee

- Caring for pets

- Brewing beer

- Gaming

1. Writing

Writing and publishing online can offer you a lot of practical value outside of being a mere hobby. You can use it to further your career and establish yourself as an expert on a topic. You can build a social media following for sharing your ideas. If you have the discipline and know how to write a good blog post, you can create your own business as a blogger by picking a niche and building an audience over time.

Once you have some experience writing, you can make money by selling your skill on sites like Upwork or Fiverr, or by reaching out directly to blogs for paid gigs. Great bloggers with niche expertise are usually in demand, and even a few clients can turn your writing hobby into a full-time business. You can also leverage professional social networking sites like LinkedIn for writing opportunities, or consider making money as a copywriter.

For more inspiration, check out:

- How Best Self Co. used blogging to sell its productivity tools

- How Wait But Why built a business around Tim Urban’s humorous and insightful content

2. Creating illustrations and designs

Illustrations and graphic design are creative money-making hobbies you can do at home on a freelance contract basis. Fiverr, in particular, features many newer artists with a variety of illustration styles. Potential clients post projects for which they need to hire artists, whether for marketing projects, custom portraits, or anything in between.

If you want more control, you can put your art on products—from t-shirts to posters to canvases—and sell those items instead. It’s important to understand that to turn your art or graphic design into a product, you’ll need to cater to a specific target market or build a unique brand. Hatecopy is an excellent example of a business that was started by an artist putting their work onto items people can buy.

With this type of small business idea, you don’t need to front the money for inventory, either. Print-on-demand services offer a low-risk way to take advantage of your graphic design hobby. You just need to create mockups of your products to list and sell online.

Once you make sales and know which designs have the most demand, you can consider investing in your own inventory.

To learn more, check out the following resources:

- Start Your T-Shirt Business: 2024 Guide

- How to Sell Art Online: The Complete Guide (2024)

3. Making music

While there are a whole range of ways to make money as a musician, one of the more interesting ways is by creating beats and samples. Beats are short hooks composed from different sounds and meant to be a background for a musician, while samples are a portion of a sound recording to reuse elsewhere.

List beats on third-party sites—such as Airbit and BeatStars—that work similarly to stock photo sites. Essentially, people purchase your music to use in their own content. Airbit artists have earned more than $50 million in all, and BeatStars has paid out over $200 million to creators.

You can also set up your own site to sell samples to other artists directly. Samples by Vanity is an online business that sells samples for artists to remix and splice together to create their own music.

You can make your audio exclusive or non-exclusive. There’s more money to be made when you sell exclusive rights, but you need to produce high-quality work. SoundOracle is an example of an online sample library with an excellent reputation—and its sounds have been featured in more than 20 Grammy Award–winning songs.

4. Cooking

Cooking is one money-making hobbies you can share with the world in a variety of ways, from starting a blog, YouTube channel, or Instagram account to diving head first into a business with your own food or cooking products. You might even take your favorite hobby on the road with a food truck business.

For inspiration, check out:

- How to Start a Spice Business: A Spice Girls Story

- The Secret Ingredients to Building a 7-Figure Meal Service Business

- Overdraft: Will His Family’s Food Business Turn into a Recipe for Success?

- How to Sell Food Online: A Step-by-Step Startup Guide

5. Gardening

Gardening is a hobby that can make you happier, healthier, and, perhaps, even a higher earner. As with many of the other hobbies on this list that make money, there are multiple ways to make your gardening hobby profitable. If you’re an avid indoor gardener, you can earn money selling mature indoor plants from your own home. Leaf & Clay, for example, sells succulents, both as one-time purchases and on a subscription basis.

Alternatively, you can also sell products and accessories to help your customers connect with their own gardening hobbies. Technology seller ēdn introduced an indoor garden to its product line, enabling customers to grow herbs and other plants in a compact space with artificial light.

Finally, you can make good money as a gardening influencer or teacher by setting up your own channel on social media, with tips and resources for the tens of thousands of users searching for good gardening content.

6. Doing photography

If you own a high-quality camera and know how to use it, you have options to turn photography from a fun hobby to a profitable side hustle.

While a side job as a freelance photographer is possible, this can restrict you to shooting local events. For a more scalable gig, sell your shots as stock photos or prints online. You can also use your photography skills to grow an Instagram following and monetize it. You need to pick a niche to serve or a style you want to capture in your photos.

Check out the how to sell photos online guide for a more detailed look at how to monetize your photography skills.

7. Producing DIY crafts

If you enjoy working with your hands, there are plenty of crafty things to make and sell: candles, bath bombs, jewelry, soap, and more.

“Handmade” communicates a certain quality, care, and uniqueness that department store alternatives often don’t offer. You can test the market for your products by selling them on a smaller scale to friends and family, at flea markets, or on Etsy, and then think about scaling into a full-fledged business as you rack up customers.

If the idea of crafting the goods yourself isn’t striking a chord, you can also make money selling kits that allow customers to flex their own maker muscles at home. Create DIY kits for fun projects, like FlowerMoxie’s DIY bridal bouquets.

Here are a few more inspiring stories about DIY businesses, and resources to show you how it can be done:

- Moving from Etsy to Shopify: An Ecommerce Migration Story

- Etsy and Shopify: How to Use Both to Grow Your Business (2024)

- Why JM&Sons Launched Their Furniture Business Out of a Shipping Container

- 9 Etsy Alternatives to Sell Your Crafts On (2024)

- 12 Easy and Profitable Crafts to Make and Sell in 2024

8. Performing comedy

Are you good at making people laugh? Do you know what the hottest memes are right now? Why not take that sense of humor and use it to build an audience on the internet? Comedy is one of the more creative ways to make money from a hobby.

You can probably think of several Instagram, Facebook, YouTube, or Twitter accounts that amassed large audiences simply by curating memes and viral videos, or by tapping into a niche of humor that no one else was serving.

Once you have an audience, you can partner with brands to do sponsored posts or turn your best running jokes into t-shirts and other products.

Examples of comedy as a side hustle that makes money include:

9. Drinking (and knowing about) coffee

Selling coffee online is a great way to turn a common hobby into a business idea that generates extra money.

Globally, people drink more than 400 billion cups of coffee every year, fueling an industry worth $60 billion annually. And as coffee drinkers have become accustomed to brewing their caffeine fix at home, it’s a prime time to capitalize on this opportunity. If coffee is one of your own passions, it could be next on your list of lucrative hobbies.

Globe-trotting creatives Jeff Campagna and Tania LaCaria found that coffee mixed well with one of their other passions: motorcycle travel. They opened up their own bike garage, Steeltown Garage Co., complete with coffee shop and merch for sale, and they’re cultivating a whole community through their hobby-based business.

Check these out for more inspiration for your coffee biz:

- Coffee Shop Business Success Stories: Craft and Mason Coffee r

- They’re Making Fair Trade Coffee a Bit Fairer

- My Starting Over Story: I Cashed Out My 401(k) to Start a Business—And Save My Family

10. Caring for pets

Do you love taking care of your pets, watching funny videos of animals online, or giving back by fostering or donating to animal-related charitable causes? If so, your love of pets can also be a profitable hobby that enables you to earn money in your spare time.

Transforming your pet hobby into a pet business can take a variety of forms. With Supakit, for instance, owners Leili Farzaneh and Kevin White turned a personal pet story into their own shop selling cat accessories.

If you have a unique pet story or extensive experience taking care of animals, you can turn your expertise into extra cash by starting a YouTube channel or social media presence devoted to pet-related content, including an online course or funny videos.

Alternatively, you can concentrate your money-making hobby closer to home by starting a pet-sitting or dog-walking business. Depending on where you live, even a local pet-sitting business can generate a surprising amount of extra money.

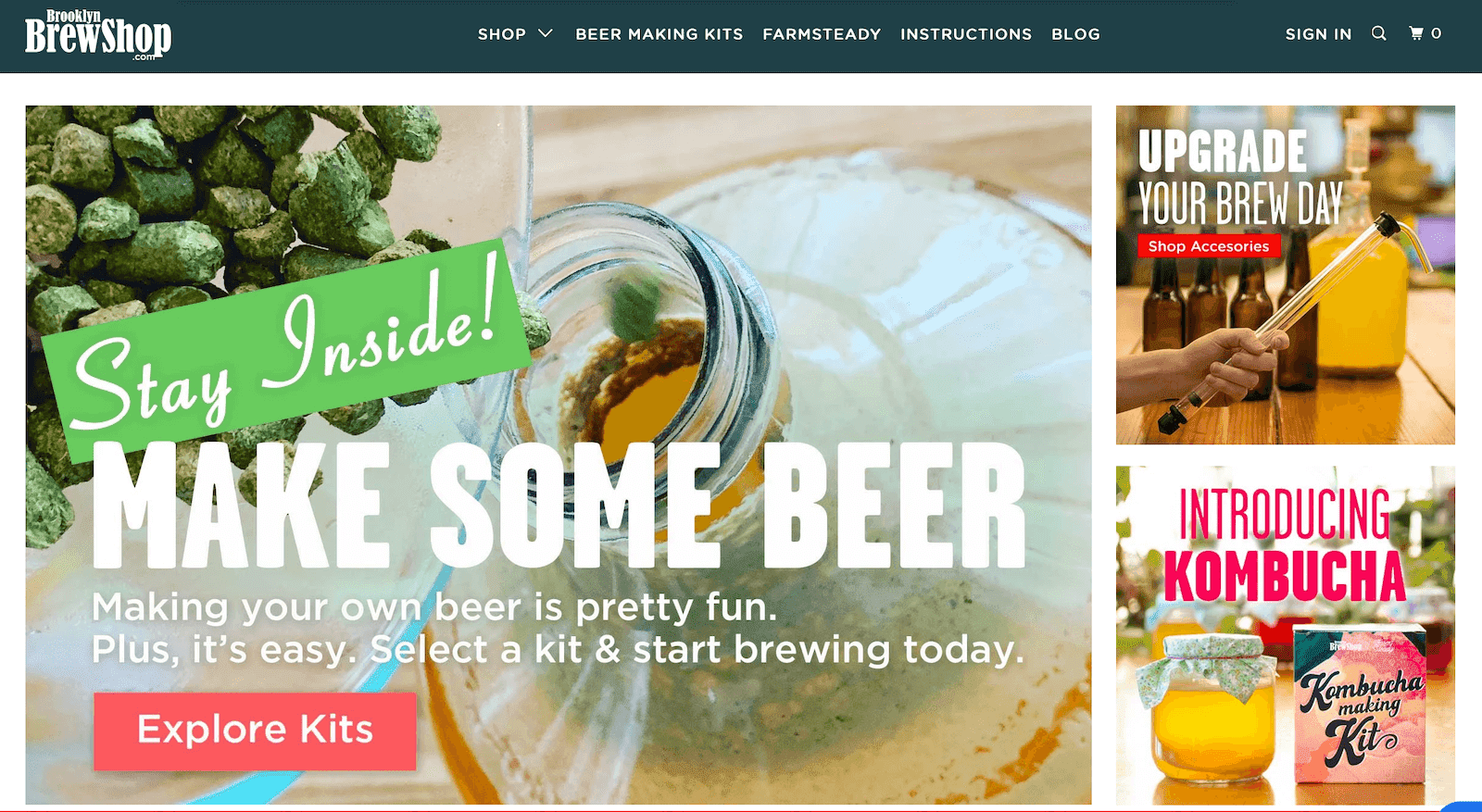

11. Brewing beer

Homebrewing, or making your own beer at home, is trending upward—with the global market for using machines to produce at-home brews at 41.2 million.

While brewing beer at home is legal across all 50 states, laws vary. Consider contacting your local jurisdiction or state’s alcohol beverage control agency, for example, as you may be required to obtain certain permits, licenses and approvals from federal, state, and local authorities. However, if you love sampling or making craft brews, there are a variety of ways you can translate that into a money-making endeavor.

Brooklyn Brew Shop, for instance, sells homebrew kits and accessories so its customers can enjoy the hobby themselves.

If you have experience making unique or award-winning beers, you can set up your own online store selling supplies and recipes to adventurous homebrewers, create an online course, or create your own YouTube channel discussing the finer points of the craft.

Finally, homebrewing is a technical hobby with lots of equipment requiring careful setup and maintenance. Still, you can build and sell brewing and kegging setups, or tutor budding brewers directly (in person or virtually).

12. Gaming

You might question the notion of gaming as a moneymaker, but even this hobby has the potential to earn you extra cash. Here are a couple ways:

- You can livestream and play video games on Twitch and make money by becoming an affiliate, a partner, or sponsored. You can also monetize gaming by posting playthroughs to YouTube and earning ad revenue.

- Invite one-time donations from your community of viewers. A perk of this strategy is that it’s relatively easy to implement—you can start making money even in the early development stages of your audience.

- Offer subscriptions to your followers, but keep in mind: Since your audience can fluctuate, this means the amount you earn through live streaming can vary greatly.

While the amount of commitment needed to make a significant income might turn gaming into work, you can still have fun if you choose to stream a game you love, are good at it, and bring your personality to the screen.

If you’re an avid gamer who understands the needs of the market, you already have an advantage as an entrepreneur in this space. You can consider building a business of your own to cater to the needs and interests of gamers. Look for inspiration from the following:

- PC Gaming Race speaks to the superiority of PC gamers.

- Corey Ferreira sold gaming glasses inspired by his own gaming needs.

How to make money from a hobby

To start a business based on your hobby, take the following steps:

1. Validate your business idea. Do some market research to make sure there’s demand for your offering.

2. Find a business name. Develop a business name that gives your business a unique identity.

3. Make a plan. Create a business plan to keep you on track to meet your goals.

4. Understand business finances. Set up business accounts, funding sources, and other money matters. (An accountant can help you with these tasks.)

5. Develop your product or service. The product development process is where you turn your hobby-inspired offering into something customers are willing to pay for, whether it’s a physical or digital product, a consulting service, an online course, or a membership.

6. Pick a business structure. Legitimize your business and protect your personal assets by picking the best business structure that meets your needs.

7. Research licenses and regulations. Do your due diligence to ensure you’re conducting business lawfully, or retain the services of a lawyer or legal consultant.

8. Select your software systems. Build your website, set up accounting software, and get the rest of your tech stack up and running.

9. Find a business location. Determine where you can operate your business, whether it be from home or elsewhere, online or a brick-and-mortar store—or both.

10. Plan workload and team size. Bootstrap or hire help, depending on your business plans.

11. Launch your business. Let the world know!

When will I make money from a hobby?

Turning your favorite hobby into a side hustle or full-time job has its perks: You’ll be your own boss, work on your own schedule, and set your own prices—all while doing work that you love. Nevertheless, it’s important to have realistic expectations about the time and work that entails.

To start, you’ll need to build a marketing strategy to let the world know about your side hustle. That strategy may begin on social media, a freelance marketplace, or a full-fledged Shopify store.

When you start making sales, it’s key to keep track of the incoming and outgoing cash. This makes tax time easier, simplifying the process if there’s an audit and helping protect your personal assets. Additionally, tracking your revenue and expenses helps to ensure that your money-making hobby becomes profitable. It’s a good idea to get set up with accounting software to manage your books.

Even with all of these preparations and more, achieving financial independence or a full-time income from your favorite hobby may take months or even years.

Make money from your hobbies today

In many cases, when it comes to discovering a profitable hobby, it’s what is done for free and fun that hints at the kinds of businesses to pursue—with passion and interest as the fuel.

If you have the urge for new pursuits but don’t know where to start, ask yourself what you’re already good at or know about.

What do you already do in your spare time that could turn into something more?

Hobbies that make money FAQ

Can a hobby turn into a profitable business?

With the right business plan, marketing strategy, and financial preparation, it’s certainly possible to turn your hobby into a side hustle and, eventually, a full-time business.

What are hobbies that make money?

Some of the best hobbies for making money are:

- Writing

- Creating illustrations and designs

- Making music

- Cooking

- Gardening

- Doing photography

- Producing DIY crafts

- Performing comedy

- Drinking (and knowing about) coffee

- Caring for pets

- Brewing beer

- Gaming

How can I turn my hobbies into money?

How you make money from your hobbies will depend on the activity. Some ideas for monetizing your hobbies include selling products online, charging for your services as an expert consultant, or creating a YouTube channel or Instagram account to generate ad revenue.