There are very few things that impact your business (both good and bad) as much as customer service. A great experience can lead to repeat business and lifelong customers. A bad customer experience can lead to unhappy customers, lost business, and even bad PR.

Yet despite the importance of customer service, many businesses continue to struggle with getting it right.

At the most basic level, customer service is the role dedicated to helping customers get the value they paid for from a product or service, especially when things go wrong. Many businesses have a dedicated customer service department, but those invested in delivering great experiences make support a company-wide priority.

While excellent customer service is especially important for businesses that have a strong financial incentive to retain their customers, the bar has risen across all industries, and customers are rewarding businesses that keep pace. This shift has, in turn, evolved support into a revenue driver. According to the American Express Customer Service Barometer:

- 50% of U.S. consumers have abandoned a purchase due to a poor service experience

- 7 in 10 shoppers say they’ll spend more money (17% more, on average) with a business that provides consistently great customer service

- 33% of customers say they’d look to switch to a competitor after a single bad service experience

One of the most important touch points you have on the customer journey map is the customer’s support experience, so your service must be outstanding. In this guide, we'll cover everything you need to know about how to provide customer service, improve customer retention, and avoid the common pitfalls of providing poor customer service.

Whether you’re just starting your online business or wanting to take it to the next level, better customer service can often be exactly what you need to level up.

- Choosing the right customer service channels

- Tips to improve your customer service

- Why good service improves the shopping experience

- How to handle tricky support scenarios

- Metrics for measuring your customer service

Choosing the right customer service channels

The support channels you choose determine the level and types of customer service you can provide.

The tricky part is deciding where you’ll meet your customers and how you’ll support them when you get there.

The right support tools help keep your standards high and your response times reasonably low.

It’s unrealistic for most small shops to accommodate every possible point of contact that exists today, but it is essential that you choose support channels that fit your business and your customers’ needs and commit to a presence there.

Here are a few foundational channels to consider.

1. Email: Provide fast, asynchronous support

Email is easier to manage than live support channels that require you or someone from your team to be available around the clock. Email also lets you set reasonable response expectations, which is a substantial benefit for time-strapped entrepreneurs. A note on your Contact page can tell customers to expect a response within a few hours, or that email support isn’t available on weekends. Providing excellent customer service often comes down to showing your customers and users you care. Setting expectations can help ensure your customers understand your customer service process and don’t have misaligned expectations.

Email automatically creates a record of your discussion, easily allowing you to see how satisfied a customer was with their support experience, ask for feedback, and keep track of conversations (something we’ll look at in more detail later in this guide).

A final benefit of email is its simplicity. There are several great tools for helping your customer service team answer emails efficiently, but if you’re a team of one wearing multiple hats, a standard inbox, such as support@yourcompany.com, is all you need to get started.

Tools for email support:

Learn more: How to Write an Effective Welcome Email

2. Social media: Support your customers in public

Social support differs from other available channels in one fundamental way: replies are generally public, visible to anyone who wants to see them. New customers frequently look at a brand's social media to determine the type of company they are and whether they take customer support seriously.

Every interaction with a customer over social media is a chance to show who you are, and that can make or break a potential relationship with each person who comes across the conversation. While social media tends to highlight negative interactions, satisfied customers can often write a positive review about their experience, which further strengthens your brand.

The key is, don’t try to be everywhere at once. Offer customer support on social media platforms where you already have a marketing presence. This should include not only channels you want to spend time on, but also the ones most used by your customers. Pew Research Center’s Social Media Use report is a useful source for figuring out which platforms fit your business.

Tools for social support:

3. Live chat: Fix customer issues in real-time

Live chat is another great way to provide quick, easily accessible support to current and potential customers. As you consider rolling out live chat, think about where you want customers to access it (e.g., high-priority pages on your store) and what you’re hoping to accomplish with it.

You may want to invite potential customers who are browsing but haven’t finished an order to start a live chat conversation, or enable live chat for customers who have just made a purchase but might have a question or issue. Live chat can often be a great channel for loyal customers to use to have their questions or problems solved quickly. New customers can also use your live chat feature to learn more about a specific product (such as sizing or shipping), letting them walk away from an interaction feeling confident about their decision to choose your brand.

Luxy Hair, for example, invites shoppers to start a conversation, while providing automatic answers to common questions.

Live chat doesn’t have to be available 24/7. You can set hours and post them on your website so customers know when they can find you. Live chat availability can be based on your highest-traffic times, with additional hours added during a sale or immediately after sending out a promotional email.

Tools for live chat support:

4. Telephone support: Offer a direct line to your business

Many customers still prefer phone calls for urgent, time-sensitive issues, especially if they have a problem with a high-priced product. Remember, a positive customer experience is about meeting the expectations of your users. Not every type of business will need telephone support, but if your target audience values being able to call your business, it can often be a wise decision to implement telephone support in your organization.

Set up a phone line where customers can reach someone directly or leave a voicemail. Small businesses aren’t expected to be on call around the clock, so post their availability on your website, along with how quickly customers can expect a voice message to be returned. You can even go the extra mile and set up a VIP phone number for your most loyal customers.

Tools for phone support:

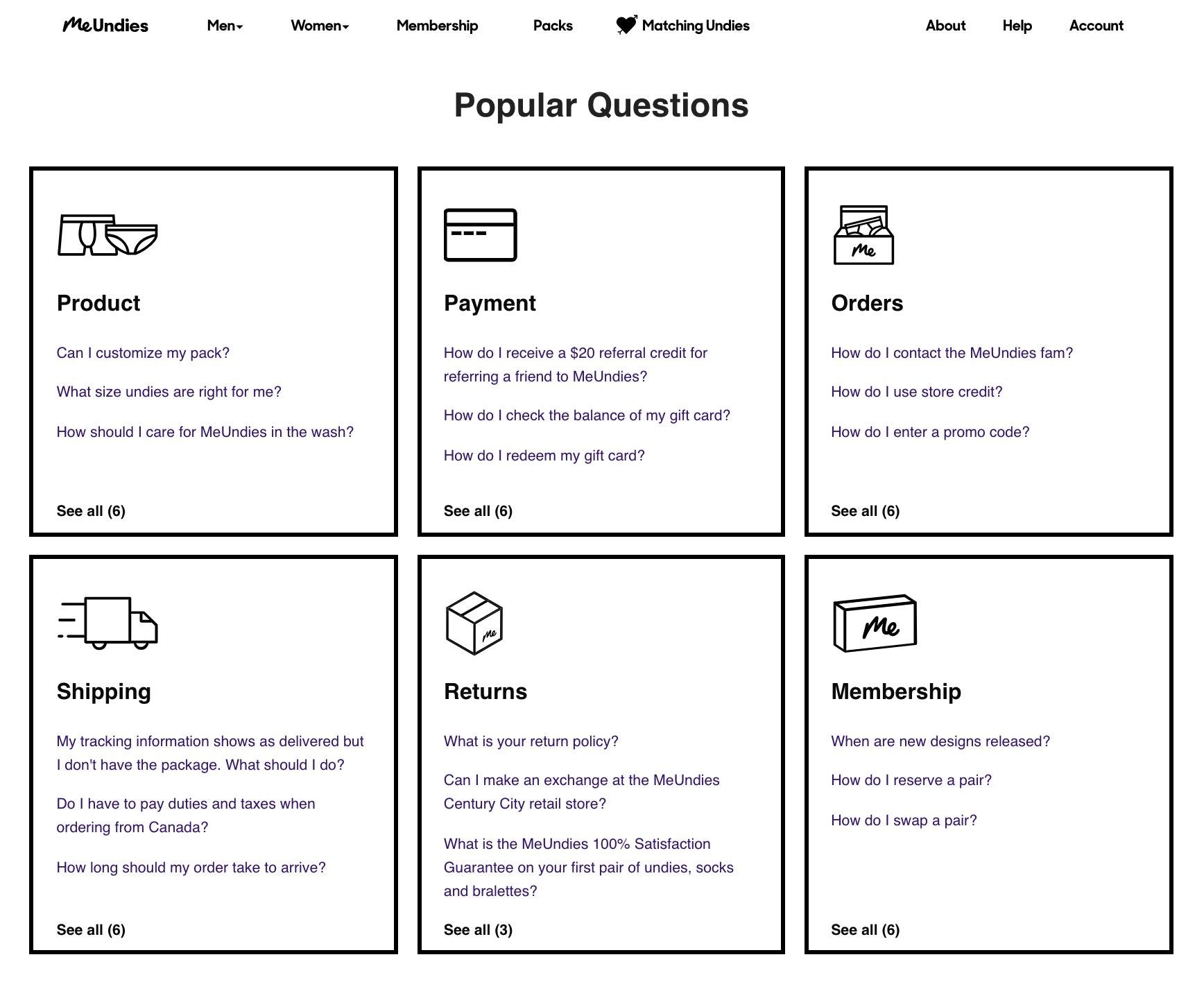

5. Help content: Equip your customers with answers

Head off (and reduce) support questions by creating a Frequently Asked Questions or Instant Answers page, or by offering other documentation that shares your basic policies and answers customers’ most common queries. Providing your customers with this information, and making it easy to find, gives them the option to self-serve and saves you valuable time.

Every piece of help content you create eventually has to be maintained.

It will take time to know what questions customers are most likely to ask. If you haven’t been operating long enough to have “frequent” questions, consider proactively providing answers around these key areas:

- Billing

- Order processing

- Shipping

- Returns and exchanges

- Customer accounts

Your support content should grow and change as your store evolves and adds new products. Revisit your FAQ page on a regular basis and make sure it’s up to date.

Tools for help content:

If you find that a particular customer service channel isn’t working for your business, change your availability or sunset it. You want your business to stand out because of the quality of your support conversations and your ability to solve problems as they arise, not because of the number of ways customers can reach you. When you juggle too many channels, you’re bound to drop one.

Essential tips to improve your customer service

- Know your product inside out

- Learn to use positive language

- Adapt your tone to the context

- Crystal-clear writing skills

- Advocate for your customers

- Use creativity to deliver frugal wows

- Understand how to set the right expectations

Customer service sometimes is undervalued due to its reliance on so-called soft skills. That’s an outdated point of view. Support has become more technical in recent years, and many of the most important customer service skills don’t come naturally to most people, even to entrepreneurs, who frequently act as customer-facing employees in the early days.

It takes time to become great at the distinct and ever-evolving skill set needed for customer service. But no matter what product you sell or where you support your customers, there are a few essential skills that lay the groundwork for all the rest.

1. Know your product inside out

Few things provoke a customer’s ire like asking a question and getting a wrong or incomplete answer. It doesn’t matter whether you offer an expansive selection of items, you’re dropshipping, or you’re new to your product category. Not knowing your products is like a singer forgetting the lyrics to a song while onstage.

Both you and your staff need a deep knowledge of what your product is and how it’s used. Training new hires, even if they’re part-time, should always start with a lesson on what you sell and how it fits into customers’ lives.

You can’t provide great customer service without being an expert on your product, especially in categories with a knowledgeable customer base, like niche hobbies.

2. Learn to use positive language

Being positive doesn’t mean confining yourself to an artificially cheery and upbeat tone. Instead, it’s about avoiding negative phrasing that can cause customers to have a negative reaction.

Positive language focuses on solutions, not problems, and gives people a sense of agency. Phrases like “you have to” or “I need you to” might be straightforward and accurate, but can cause customers to feel like the burden to solve the problem is on them, even if it wasn’t their fault. You can go from negative to positive by making a few simple changes:

- Negative: “To start, you’ll have to check your order number. OK, thanks. It says here that the product won’t be available for a few weeks, so I can’t place an order for you until it arrives at our warehouse.”

- Positive: “First, let’s verify your order number. Great, thank you! It looks like that product will be available next month. I can place an order for you as soon as it reaches our warehouse.”

Customers don’t want to be lectured on what you can’t do for them, they want to hear what options are available to solve their problem. To keep a customer in your corner, make sure your customer service team is committed to finding a solution and uses language that invites them to collaborate with you on finding that solution.

3. Adapt your tone to the context

There are two important concepts in business communication: voice and tone. Essentially, voice is the underlying style you want your brand to have, and tone is the appropriate style for a specific context. (To see how Shopify handles voice and tone, check out Polaris, our publicly accessible style guide.)

A fun-loving dog brand might want to mirror the enthusiasm its customers have for their furry friends. However, responding in that voice without adjusting your tone to an email about a late shipment or a damaged order might come across poorly. Similarly, while your brand’s voice generally should be consistent, consider matching the tone of customers who have a different conversational style.

It can be challenging not to abandon your distinct voice for cold corporate speak during a support conversation with a customer who has a problem. Encourage your customer service team to stay consistent and use your brand voice as a foundation while adjusting your tone based on the customer’s temperament and their reason for contacting you.

4. Crystal-clear writing skills

One of the biggest causes of miscommunication is writing that’s clever at the expense of being clear. Creativity is an important part of making a support experience stand out, but your first priority is writing clear, direct answers that can’t be misunderstood.

It’s easy to assume everyone knows what you know, an unintentional bias known as the curse of knowledge. To avoid this mistake, treat customers as competent, but don’t make assumptions about what they know.

Great support starts with writing clear, direct answers that can’t be misunderstood.

For example, if you’d like a customer to share their order number, don’t just tell them to look for it in their inbox. Provide step-by-step directions on how and where they can find it. Think about the instructions you’d give, and how you’d phrase your response, if you were helping a friend of a friend troubleshoot a problem.

Something else to consider is the way you style your replies, especially over email. Careless styling can cause confusion. Favor easy reading by making liberal use of bullet points, line breaks, and boldface to break up long replies into scannable sections.

5. Advocate for your customers

Traditionally, businesses are expected to have empathy for their customers. But empathy is only a passive first step in the equation. More important than empathy is advocacy. Advocacy is championing the concerns of your customer and being active in identifying potential solutions. Advocacy works because it’s easy to identify and understand—it’s felt through action and through descriptions of attempted action.

Customer interactions have three phases:

- Sensing: This happens at the start of a conversation, when you ask questions in order to pinpoint what caused the customer’s issue.

- Seeking: After the problem is identified, you then explore what can feasibly be done to solve that problem.

- Settling: Once solutions are surfaced, you can work with the customer to decide on the best outcome.

Advocacy most often occurs during the “seeking” phase. Telling a customer what solutions you’ve explored can make them even more receptive to a less than perfect outcome. If a customer can see the logic that led you to suggest what you did, they’ll be more understanding. If you offer a lackluster solution with no context, they might assume you’re trying to brush them off.

The worst thing you can do on a customer service call is appear uncaring. Don’t let a placating “We’re sorry!” do all the work for you. Take control of the situation, show the customer you’re motivated to identify real solutions, and suggest a firm next step or a shortlist of realistic options.

a "dead end in disguise" to a person who's asking for help. It's important to remember the reason they've reached out for help in the first place is that they've come to a dead end already. They often aren't sure what their options are for moving forward, or how to decide which option is best.

a "dead end in disguise" to a person who's asking for help. It's important to remember the reason they've reached out for help in the first place is that they've come to a dead end already. They often aren't sure what their options are for moving forward, or how to decide which option is best. Following up a sincere apology with next steps is key to navigating tough interactions empathetically. First, this approach acknowledges the complexity of their situation and any emotions they may be feeling. Second (and more importantly), it shifts the focus and tone of the conversation back towards addressing the problem at hand. It builds common ground instead of focusing on how frustrating dealing with said problem may be.

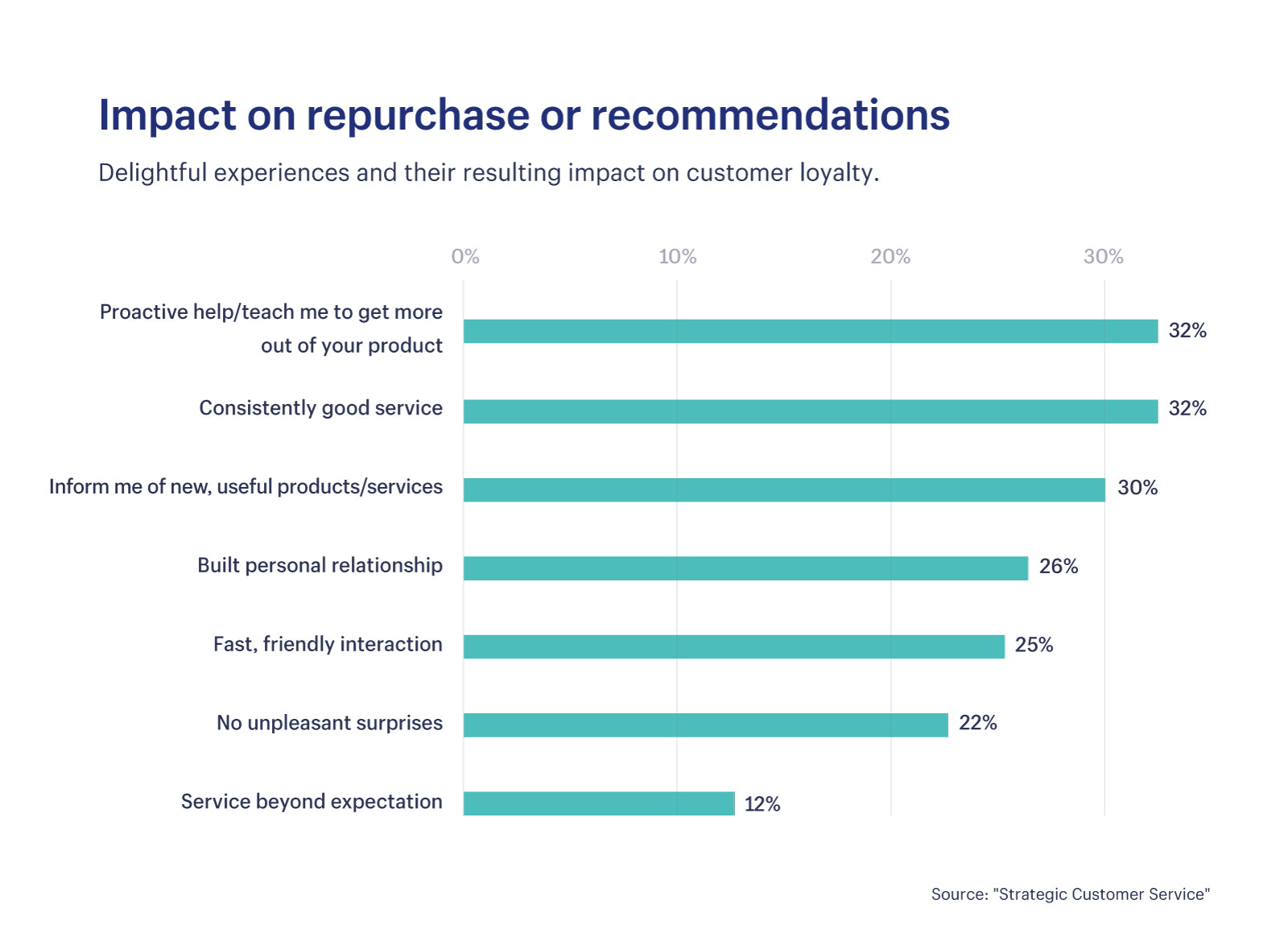

6. Creativity to deliver frugal wows

“Frugal wows” are gestures that have no monetary value for a customer, but create lasting loyalty through the gesture’s thoughtfulness.

Customers are drawn to things that are free, but free items alone don’t necessarily make them loyal. Frugal wows rely on creativity over capital. Here are a few examples:

- Sending handwritten thank-you notes

- Including creative packaging inserts

- Providing samples that complement a purchase

- Offering surprise post-purchase discounts

- Creating personal connections with short videos

As your business grows, it’s good to find ways to deliver repeatable wow moments. Strategically, it’s better to delight many customers a little than one customer a lot.

Customers get to decide what’s delightful, not companies.

Margot da Cunha, formerly of Wistia’s customer success team, created a personal connection by using a video in her email signature. Da Cunha tracked her engagements and found that 87% of customers she emailed clicked on the video and often watched all the way to the end. The only cost was a few minutes of her time.

In the quest for efficiency, it’s easy to forget that word of mouth isn’t gained through neutral experiences. Wow moments shouldn’t be the main pillar in your support strategy, but this type of little unexpected extra for your customers still will go a long way in helping build your reputation.

Learn more: A Thank You Goes a Long Way: 44 Creative Ways to Say Thanks for Customer Purchases

7. Understand how to set the right expectations

Setting the right expectations can directly influence how customers perceive the quality of your support and make the difference in whether they walk away happy or dissatisfied.

Even minor details make a difference: if your chat widget says “Get an answer instantly” and your average response time is actually three minutes, your customers will end up frustrated for reasons you could have avoided.

The golden rule is to under-promise and over-deliver, something that’s easier said than done. There will be times when you’ll feel internal pressure to make unrealistic promises, like if you’re unsure exactly when an item will be back in stock, or if something went wrong with an order and you want to make it up to the customer. Big promises you’ll have a hard time living up to, let alone exceeding, can inflate a customer’s expectations.

Be especially careful in regards to time. Let customers know at important touch points (such as on your Contact page) how quickly they can expect a response. Don’t make promises in areas where you can’t exercise complete control, like ambitious shipping times.

Why good service improves the customer experience

Customer service needs to be more than a necessary cost of doing business. It needs to create value.

Fortunately, great support provides an open and direct line to your customers, which means it doesn’t have to be limited to reactive patching of small issues. Support can result in major improvements to the shopping experience for future customers, and even provide insight on how you can accelerate your business.

1. Effective support solves the root cause

Customer service creates value by surfacing otherwise hidden problems through the unprompted feedback it provides. This can help you prevent issues for future customers by solving the root cause of a problem, rather than simply treating its symptoms.

For example, if you field the same question about a product multiple times a day, you can rewrite that product’s description on your webpage, creating a better, more informative experience for future customers—saving yourself the time you were spending responding to that particular question.

Solve the root cause of a customer's issue, don't just treat the resulting symptoms.

This is an example of how efficient customer service can be driven by empathy: you’re not looking to avoid customers, you’re looking to avoid problems. Customers don’t want to contact you about mundane product details. When you use support to prune away problems, you create a better experience for future customers. You’ll also likely see a net improvement to your store’s buying experience and potentially your overall sales, because you’ve fixed hurdles that were tripping up shoppers.

Create a simple system to track issues you hear about more than once. If you’re not using a dedicated support tool like a help desk, a simple spreadsheet or a Trello board will do.

2. Support can encourage more valuable conversations

Not every customer can be given red carpet treatment during a service interaction; it simply doesn’t scale. Without optimizing for efficiency, some customers may have a good experience at the expense of others.

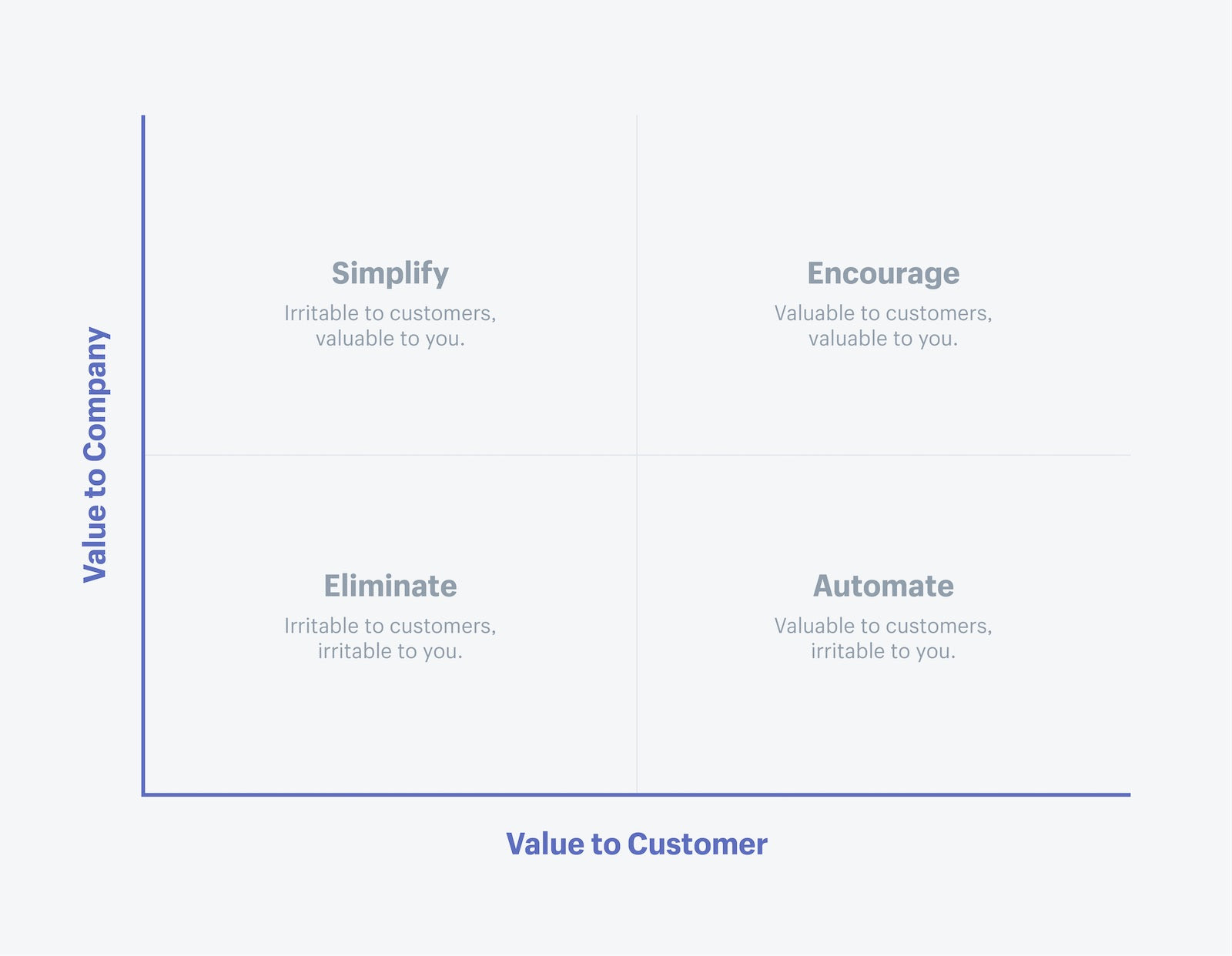

Bill Price, former Global VP of Customer Service at Amazon, understands this problem first-hand. The only way to improve customer satisfaction is to understand what kinds of conversations you’re having, and what kind of conversations you should (or could) be having with customers. Price and fellow consultant David Jaffe share how they approach this opportunity in their book, The Best Service is No Service.

One useful takeaway from Price and Jaffe’s book is the philosophy of reducing “irritable contacts” for entrepreneurs of all sizes. Irritable contacts are conversations neither you nor your customers want to have. They’re represented in the bottom left quadrant of Price’s value-irritant matrix.

Reality is more chaotic than a 2 x 2 matrix, but this perspective can fundamentally shift how you look at customer service. There’s an ideal way for each category of conversation to be handled:

- Valuable to you, valuable to customers. If you’re helping to close a sale, saving a sale already made, or learning something new from customers, you’re extracting a lot of value and want to encourage these types of conversations as often as you can.

- Valuable to you, irritable to customers. If customers are annoyed by the hoops you’re asking them to jump through, you should lower the barrier by making these steps as easy as possible. Sometimes individual steps can’t be eliminated, but they often can be simplified.

- Irritable to you, valuable to customers. If the conversation needs to happen but provides zero or negative value to the business, self-service in the form of FAQ pages and help docs can provide customers with the quick answers they need.

- Irritable to you, irritable to customers. Do whatever you can to eliminate the source of the problem. No one benefits from these conversations, so consider them a leaky pipe. You can place a bucket to catch the drip temporarily, but, long term, you need to fix the leak.

You might think all is well once a customer gets the solution they asked for. But Price and Jaffe’s framework shows it isn’t always that simple. Some conversations are indicative of a larger problem, so taking a “ticket closed” approach to supporting your customers will result in a number of missed opportunities.

3. Customer service can provide unexpected insight

Education is at the heart of excellent customer service: education for your customers and education for you. Customers will contact you with questions and issues you’d never be able to surface on your own. Constructive feedback is a gift because it helps you spot opportunities that can increase customer lifetime value and shift your entire business.

One important example: customers repeatedly asking you whether you plan to carry a specific product or accessory is a signal that you may want to look into why they’re asking and what exactly they’re looking for.

Not every customer issue will raise its hand and say, “I’m a problem you need to solve!”

Businesses that don’t pay attention to customer behavior and feedback go the way of the dinosaur; just look at the dozens of legacy brands that have fallen by the wayside after a technological shift. Ignoring customers is just plain poor customer service, and is usually a mindset problem of entrepreneurs thinking they know better. You might be uniquely suited to solve problems, but customers are uniquely suited to share the problems that need solving.

Support is one important way you can keep your finger on the pulse of customer demand and product opportunities, as well as provide a higher quality customer service. You just need to be willing to listen.

How to handle tricky customer service scenarios

Hearing from upset customers can be one of the most challenging parts of running your own business. It’s easy to take their frustrations personally, even if you know there’s nothing you could have done differently.

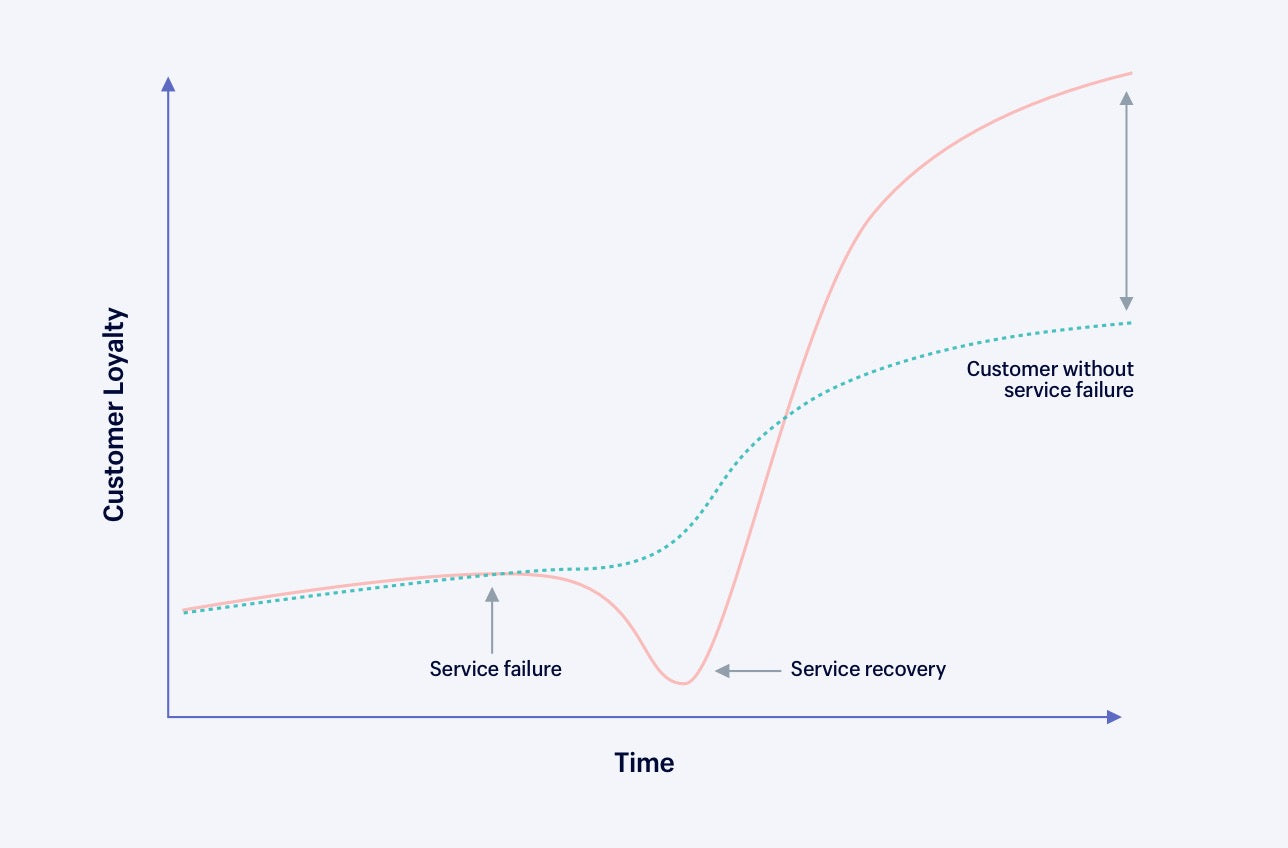

Mistakes are impossible to avoid completely, but the silver lining is that they often provide an opportunity to show your commitment to earning a customer’s business. If you can recover from a blunder, your customer might end up more loyal than if the issue had never happened. This is known as the service recovery paradox, a term first coined by Sundar Bharadwaj and Michael McCollough.

When an upset customer contacts you, don’t think of it as a missed opportunity to make a good impression, but rather a chance to make amends. Customers want to feel heard and know that you’re in their corner to help them reach a positive outcome.

Below are some hands-on strategies you can use to turn a customer’s experience around, even when a perfect resolution feels out of reach.

Predict the most likely problems in advance

Some problems will come up more frequently than others. For example, most merchants will be no stranger to customers asking why their order hasn’t arrived. It’s worth creating a template to address questions like this. Try to identify common questions early on so you’re ready for them in busy sales seasons. Once you have a well-constructed response that suits your brand, you can save it as a model for future use.

Here are a few sample scenarios and responses to help you get started.

❓ Lost orders:

Hi Geraldine,

I’m very sorry to hear your order hasn’t arrived yet. I’m sure you were looking forward to trying out that new Super Splash with the warm weather coming this week.

The delivery company hasn’t been able to locate your parcel with the tracking number, so I’ve sent out a replacement delivery that should arrive by Friday, August 3. I’ll check back in to make sure it arrives! This isn’t something we see happen often, so again, I’m sorry this wasn’t a perfect experience for you.

Thank you for bringing this to our attention. If there’s anything else I can help you with in the meantime, please let me know.

Thanks,

Rachel

😕 Customer unhappy with product:

Hi Stanley,

Thank you for getting in touch to let us know about the trouble you’re having with the Orange Peeler 2000. That sounds really frustrating. I’m not a morning person either, so I totally understand.

I can do one of two things to try and make this right for you:

- I can assist with an exchange for a different peeler and refund the difference. We’ll cover the shipping costs, of course.

- Or we can jump on a call today, and I can help walk you through how to use the OP 2000. That way, you’ll be able to get all the benefits from the peeler right away.

Let me know what you’d like to do, and a good number to call you at if you’d like to go that route. We want to make sure all of our customers are totally satisfied with their kitchen purchases, so thank you for giving us an opportunity to fix this. I’m here to help!

Sincerely,

Katie

📦 Package is damaged:

Dear Peter,

Thank you for sending in your feedback about the state of the packaging you received your product in. I want to let you know how much we care about the quality of our deliveries. This isn’t our usual standard.

Going forward, you can expect to receive your order in much better condition, and I’m sorry we didn’t measure up to your reasonable expectations this time.

We appreciate you writing to us about this. If there’s anything else we can assist you with, please let me know. I’m here to help.

Sincerely,

Robert

Bringing it all together

If you like to use mnemonics, try LATTE, which is a useful method of turning around a frustrated customer that Starbucks uses to train their baristas:

- Listen

- Acknowledge the problem

- Take action

- Thank them

- Explain what you’ve done

Review your reply before sending it to ensure you’ve wrapped all these steps up into one empathetic, helpful response and not missed anything.

Learn more: 7 Common Shipping Questions and How to Address Them Head on

Know how to close a customer conversation

New entrepreneurs often fumble the end of challenging support conversations by not knowing how to preempt follow-up issues or end in a way that leaves customers feeling heard and appreciated.

Try to empathize with customers by viewing their questions as holistic events: along the way to their original goal, the customer had to stop and ask for help. If you fix their current issue, where are they off to next? What will they have to do? Be able to identify that step and provide help before they ask.

If your support strategy is limited to the “warm fuzzies,” you'll end up leaving customers out in the cold.

This is what Gartner’s Nick Toman calls “next issue avoidance,” a concept that trades time and effort for reduced contact and increased customer satisfaction. This email from Warby Parker delivers on next issue avoidance in spades:

Multiple options are offered to address the next step of sending the glasses back, including preemptive answers to FAQs about the returns process. There’s no need to ask clarifying follow-up questions, because the next steps are already provided.

When it comes to closing a support conversation, think of it as having the right signoff. This is crucial because perception counts for a lot. You want to use language that leaves no doubt you’ve fully addressed a customer’s issue, appreciate the trust they’ve placed in you, and are open to hearing from them again anytime.

The best language to use when closing a support conversation depends on why a customer contacted you, but here are a few simple examples that show how you can make slight adjustments depending on context.

After product or shipping feedback:

“Thanks so much once again for sharing your thoughts on this. Please reach out if anything else comes up, and have a great rest of your day.”

After an issue using your shopping cart:

“I’m so happy that it's working as expected now! Let us know if you run into any other trouble, and have an excellent week.”

After you’ve found a solution to their issue:

“I’m glad that helped! Let us know if you have any other questions or concerns, and enjoy the rest of your week.”

While this might seem straightforward, the most important support moments are defined by thoughtfulness and sincerity; there’s no need to overcomplicate what works. By thanking your customers and inviting them to reach out again if they have trouble, you show them that:

- You care about what they have to say and their thoughts on your brand and product

- You understand the issue they had was because of your product and not something they did

- You will continue to solve the issue if your response doesn’t do the trick

- Even if you don’t always get it right, you’re committed to making things right

Metrics for measuring your customer service

Happy customers are repeat customers, but how do you know if you’re making your customers happy?

Most support metrics belong to one of two main categories: quality and performance. Quality metrics, like customer satisfaction and Customer Effort Score, measure how customers feel by asking them about their experiences with your business. Performance metrics (speed, volume, etc.) contain data around activity that is left to you to interpret, such as total number of conversations or your average reply time.

Quality metrics for customer service

Customer satisfaction

Many new entrepreneurs begin tracking quality by measuring customer satisfaction (CSAT). Using a number of tools, you can send customers a satisfaction survey at the end of each support interaction, giving them an easy way to share feedback and provide commentary on what they did and didn’t like. You can even embed customer satisfaction surveys at the bottom of every email you send.

Keep in mind that most CSAT tools will show your average score. Averages mean very little to the customer who had an especially poor experience, so be sure not to lose sight of personal feedback and anecdotes. Every customer counts. Keep track of low ratings so you can follow up, make things right, and learn from what went wrong.

CSAT is helpful in evaluating customer sentiment, but it’s limited to a single moment in time and is fairly broad. It’s also difficult with CSAT scores to parse out the real reason for dissatisfaction: it may have been your tone, your policy, or even the product itself. That’s why it’s important to read the commentary that comes along with your ratings.

"Not everything that counts can be counted, and not everything that can be counted counts."

Customer Effort Score

Customer Effort Score (CES) measures the amount of work a customer felt they had to do to get their issue solved. Customers who have to send several emails, repeat their requests, or search for hours trying to find a solution would report a “high-effort experience.”

Tracking reported customer effort and finding ways to reduce hurdles is a growing trend in support. Gartner, which originated the idea of measuring customer effort, has shared data showing 94% of customers with low-effort interactions intend to repurchase, compared to 4% of those experiencing high effort. CES can be revealing because customers want to buy from businesses that provide effortless experiences.

Performance metrics for customer service

Incoming support volume

How often do customers need to contact you for help? A strong indicator of the state of your customer experience is the ratio between the number of orders (or customers) and the resulting support volume. Presumably, the less often customers have to contact you, the easier and better a time they’re having doing business with you.

Calculate either the percentage of orders that result in a support request, or what percentage of customers ask for help after a purchase. Then divide the number of support requests by the number of orders (or customers) in a given timeframe (a month is usually a good standard to follow). Over time, try to drive this ratio down by using the feedback you get to remove confusion and reduce the number of problems customers run into.

This ratio can help you plan your hiring and staffing to meet demand. If you find customers are contacting you so often that the speed and quality of your replies are suffering, it’s time to hire an extra set of hands; even part-time help can make a big difference.

First response time

According to a study by Arise that surveyed 1,500 US consumers, 80% of customers now expect a service response within 24 hours, 37% within an hour. There’s no doubt speed is a pillar of exceptional customer service.

There are many ways to measure speed, but one of the most common is the average time to first response. Time to first response is essentially the length of time the customer has to wait from the time they submit their question to the time you send your first response.

Every help desk tool, by default, will measure the average time to first response. Start by tracking this average. Later, you can track nuances in the data that may be hidden by averages. If a six-hour response time is your goal, for example, then what percentage of your total conversations are answered within six hours? What’s the longest time a customer has to wait for a reply?

Types of conversations

A proactive move most store owners benefit from is setting a basic tagging or categorizing strategy for their incoming support requests.

The common pitfall to avoid is tagging conversations with labels you’ll have a hard time filtering through later on. Ineffective support tags often resemble bookmarking apps with comically unhelpful label descriptors like “Cool” and “Interesting.” If you’re not precise with your tags, you won’t know exactly what’s changing when you use them to examine the past.

When all of your support conversations are lumped together it's hard to draw meaningful conclusions.

In The Best Service is No Service, Price and Jaffe recommend a pair of questions to ask when evaluating whether a tag or category name is going to be useful:

How would a spike or a crash make you feel? If the use of a specific tag suddenly increased, could you tell if it was due to good or bad conversations? Seeing a rise in the number of support conversations tagged “Payments” doesn’t reveal as much as a jump or dip in contacts labeled “Payment error.” A spike in the former may cause a raised eyebrow; a spike in the latter will stop you in your tracks.

What’s more important: knowing what, or knowing why? Price and Jaffe note that tags defining what happened, such as “Shipping issue,” are often far less useful than tags identifying why it happened. For example, it would be better to split “Shipping issue” into the tags “Late by shipper” and “Warehouse delays” to make the real source of the problem obvious.

In reality, all of the metrics we’ve discussed are interconnected. As you track the metrics you’ve chosen, be vigilant about the connections between them.

For example, you may notice that as time to first response goes down, CSAT goes up, but only to a certain point. Perhaps there is a threshold where speed begins to hurt the quality of your responses. Shifting customer satisfaction scores, for example, are often indicative of a larger problem that has simply surfaced in your support inbox.

Great support is a competitive advantage

Initially, many business owners may feel that support is an assigned chore tied to the cost of doing business, or they might view it from another extreme and feel obligated to deliver mistake free customer service. Eventually, however, most entrepreneurs find solid middle ground and realize support is strategic, a revenue driver, and a potential competitive advantage.

That’s not to downplay the human-to-human element. Despite the need for strategy, measurement, and operational efficiency, at its heart, a positive customer service experience will almost always rest on creating personal, human connections with customers and ultimately help improve customer retention down the line.

Illustrations by Lynn Scurfield.

Benefits of providing good customer service FAQ

What are the main benefits of providing good customer service?

There are many benefits to providing good customer service, including: Increased brand loyalty, better customer lifetime value, strong relationships with customers, increased sales, and a positive brand image.

Why is providing good customer service important?

While the quality of your products and services is important, good customer service can often be the difference between creating lifelong customers and giving yourself a competitive edge.

How do you provide good customer service?

There’s no “right way” to provide good customer service, but providing quality customer support often comes down to listening, proactively communicating, being solution oriented, and making sure your customers feel heard.